Good Afternoon!

Insider trades can reveal valuable insights into where executives and insiders see potential. By analysing recent activity, I've uncovered a few standout opportunities that could offer promising returns.

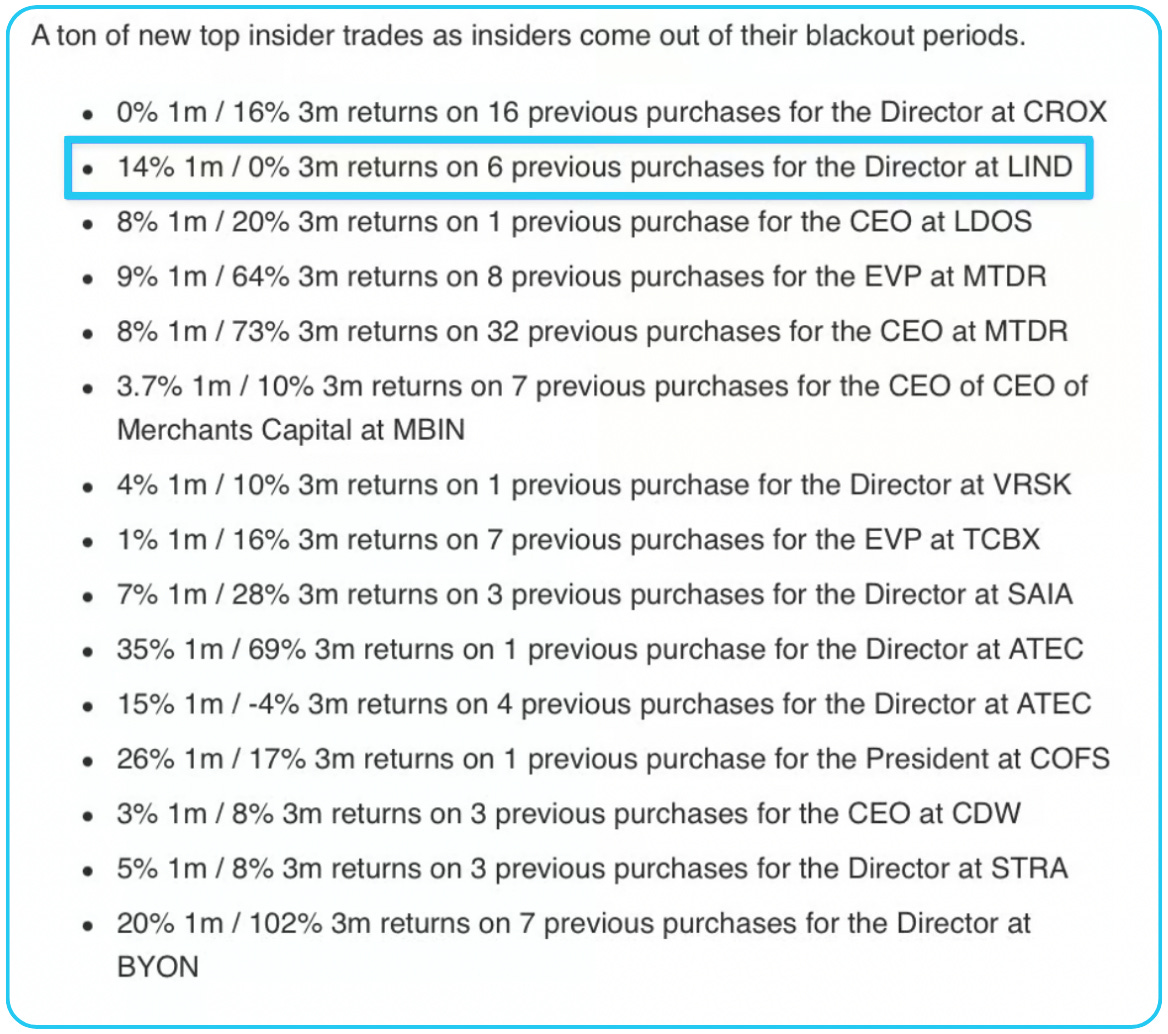

After sifting through 239 insider trades, I’ve calculated which ones show the most promise, and here’s what I found:

- $LIND: Up 79% in 3 months after insider activity

- $PEB: CEO makes a 3-point purchase

- And more…

I’ll keep digging into the data to bring you the latest and most actionable insider moves every day.

Have a fantastic day!

Jack

P.S. Click here for the Google Sheet with all of the data for the last 30 days.

💰 Previous Winner

$LIND was one of six stocks identified in our August 6th email that rallied over 30% within three months. This surge followed a $275k purchase by a director with a strong track record, averaging 14% returns over a 1-month period post-transaction. The technical breakout was likely supported by heightened investor confidence in response to this strategic insider buying, signaling potential undervaluation or upcoming catalysts.

It opened at $7.42 and is up to $13.28 (+79%).

New 3-Point Purchases

3-point purchases are the highest-rated insider trades. Remember, returns and win rates are calculated using the previous purchase trades by the insider.

CEO Purchase at AN2 Therapeutics, Inc. ($ANTX)

In a notable transaction, the Chief Executive Officer at AN2 Therapeutics, Inc. ($ANTX) purchased 50,000 shares at $1.00 per share, totaling $49,970. This transaction increased their vested holdings by 3.8%, signaling a vote of confidence in the company's near-term prospects. Currently, the stock trades at $1.00, reflecting a slight increase of 0.1% since the purchase. This marks the CEO's second-largest transaction, closely aligned with their median purchase size of $51,870, indicating a calculated and consistent investment approach.

Why This Purchase Deserves Attention

This buy is particularly compelling given the CEO's historical performance in similar transactions. The insider boasts a 100% win rate, achieving weighted and median returns of 36% over 1 month and 54% over 3 months. Such a track record is rare and suggests that the CEO has a keen understanding of value opportunities within AN2's strategic operations.

The purchase size, while slightly below their median, is still substantial and consistent with previous transactions that have yielded significant stock price appreciation. The insider's timing aligns with historical patterns of share accumulation preceding major stock price movements, suggesting confidence in upcoming developments or catalysts that could positively impact shareholder value.

Technical Analysis and Market Position

At $1.00, $ANTX trades near its lowest price in recent months, potentially signaling an undervaluation. A look at the Relative Strength Index (RSI) shows the stock nearing oversold territory, which could encourage technical traders to enter positions. Additionally, the 50-day moving average is converging with the current price level, a key point that may act as a pivot for a potential breakout if buying pressure increases.

The stock’s volume has remained steady, suggesting a lack of significant selling pressure despite the low price. This stability, combined with the insider’s purchase, indicates that investor sentiment may be shifting toward accumulation rather than liquidation.

Historically, insider purchases at or near 52-week lows have often acted as precursors to meaningful price recoveries. This is particularly true for biotech companies like AN2, where insider buying frequently coincides with internal knowledge of pending milestones such as clinical trial results or regulatory approvals.

Strong Historical Insider Performance at $ANTX

The CEO’s historical insider performance provides further validation of this purchase's significance:

- 1-Month Returns: Weighted and median returns of 36%, with a perfect 100% win rate (1 out of 1 transaction). This suggests strong short-term upside potential.

- 3-Month Returns: Weighted and median returns of 54%, also with a 100% win rate. This highlights sustained momentum following prior purchases.

- 6-Month and 1-Year Returns: While limited data is available, the high short- and medium-term returns suggest the CEO's trades align well with pivotal company developments.

Broader Industry and Company Context

AN2 Therapeutics operates within the biotech sector, known for high volatility but significant upside potential tied to product pipelines and regulatory developments. The company's focus on rare diseases and anti-infective treatments places it in a niche market with substantial growth opportunities. Recent trends in biotech funding and collaborations have favored companies like AN2 that target underserved therapeutic areas.

This purchase could indicate confidence in AN2’s ability to secure new partnerships, advance clinical trials, or achieve other milestones that would drive valuation. Additionally, the broader biotech sector has seen renewed interest as macroeconomic pressures ease, potentially creating a favorable environment for $ANTX to capitalize on its unique positioning.

Technical and Sentiment Indicators

From a sentiment perspective, insider activity at AN2 Therapeutics has historically acted as a strong signal for retail and institutional investors alike. The current purchase, combined with the company’s low valuation and positive technical indicators, suggests the stock is primed for upward movement. Should $ANTX break through its immediate resistance at $1.05, it may attract momentum traders, further accelerating gains.

Summary

The CEO’s purchase at $ANTX stands out due to its alignment with historical patterns of insider buying and subsequent stock price appreciation. With a proven track record of generating substantial returns within short timeframes and the stock trading at a potentially undervalued level, this transaction may signal significant upside potential. Combined with technical indicators, broader industry trends, and AN2’s positioning in a high-growth therapeutic niche, this insider purchase serves as a compelling signal for investors seeking exposure to biotech opportunities. (Link)

Chairman and CEO Purchase at Pebblebrook Hotel Trust ($PEB)

In a strategic move, the Chairman and CEO of Pebblebrook Hotel Trust ($PEB) acquired 7,000 shares at $12.06 per share, for a total investment of $84,389.90. This purchase increased their vested holdings by 0.4% and marks their 22nd largest transaction out of 24 historical purchases. The stock has since risen to $12.31, reflecting a 2.1% gain from the insider’s entry point.

Although smaller than their median purchase size of $289,000, this transaction stands out due to the insider’s robust historical track record and the potential signals it provides about the company’s outlook.

Why This Purchase Catches the Eye

The CEO’s track record with insider purchases is noteworthy, boasting a 73% win rate over a 1-month period and a 64% win rate over 3 months. The weighted average returns of 8% over 1 month and 14% over 3 months demonstrate consistent profitability, suggesting that this insider has an acute understanding of value opportunities within Pebblebrook Hotel Trust’s operations.

While this purchase ranks on the smaller side of their historical transactions, the timing is intriguing. Insider activity at Pebblebrook often coincides with key turning points in the stock’s trajectory, and this latest buy may reflect the CEO's confidence in upcoming catalysts or the company’s ability to navigate current market challenges effectively.

Technical Analysis and Price Action

Currently trading at $12.31, $PEB is showing signs of strength, with the stock up 2.1% since the purchase. The price is approaching the 50-day moving average, which has historically served as a key resistance level for the stock. A breakout above this level could attract technical traders and signal the start of a more sustained upward trend.

Pebblebrook’s stock also hovers near its recent support level of $12.00, a price point that has previously attracted significant buying interest. This confluence of support and insider activity suggests that the stock may be poised for a rebound if broader market conditions remain favorable.

Additionally, the stock’s Relative Strength Index (RSI) is trending upward but remains below overbought territory, leaving room for further appreciation without triggering technical selling pressure.

Strong Historical Insider Performance at $PEB

The Chairman and CEO’s historical performance reinforces the significance of this transaction:

- 1-Month Returns: Weighted average of 8%, median of 6%, and a 73% win rate (16 out of 22 trades). These statistics suggest a high probability of short-term upside following their purchases.

- 3-Month Returns: Weighted average of 14%, median of 9%, and a 64% win rate (14 out of 22 trades). The medium-term data indicates a solid track record of delivering above-market returns over this timeframe.

- 6-Month and 1-Year Returns: While detailed figures are unavailable, the consistent returns over shorter periods imply a strong alignment between insider activity and positive stock performance.

The insider's ability to generate favorable returns across various timeframes underscores the reliability of their transactions as indicators of potential price appreciation.

Industry and Macro Context

Pebblebrook operates in the hospitality and lodging industry, which is heavily influenced by macroeconomic factors such as travel demand, consumer spending, and interest rate trends. Despite headwinds from higher borrowing costs and economic uncertainty, the sector has shown resilience, with urban and luxury segments recovering steadily post-pandemic.

The timing of this purchase may suggest confidence in a broader recovery within the hospitality sector, particularly as travel demand continues to normalize and occupancy rates improve. Additionally, Pebblebrook’s focus on high-end properties in prime locations could position it well to capitalize on these trends, especially as corporate and leisure travel regain momentum.

Broader Implications and Catalysts

The CEO’s purchase aligns with a period of relatively low valuation for $PEB, as the stock trades near its 52-week low. This could suggest that the insider perceives the current price as an attractive entry point, potentially ahead of operational improvements or strategic initiatives.

Furthermore, Pebblebrook has a history of share buybacks and dividend adjustments, which could serve as catalysts for stock price appreciation. Insider buying at this juncture may reflect expectations of such shareholder-friendly moves in the near future.

Summary

This insider purchase at $PEB, while modest compared to the CEO’s historical transactions, stands out due to its timing, the insider’s proven track record, and the stock’s favorable technical setup. With historical data pointing to consistent gains following similar purchases and broader industry trends supporting a potential recovery in the hospitality sector, this transaction could signal an attractive entry point for investors.

As $PEB approaches critical technical levels and the company positions itself within a recovering market, this insider activity serves as a compelling indicator of potential upside in the months ahead. (Link)

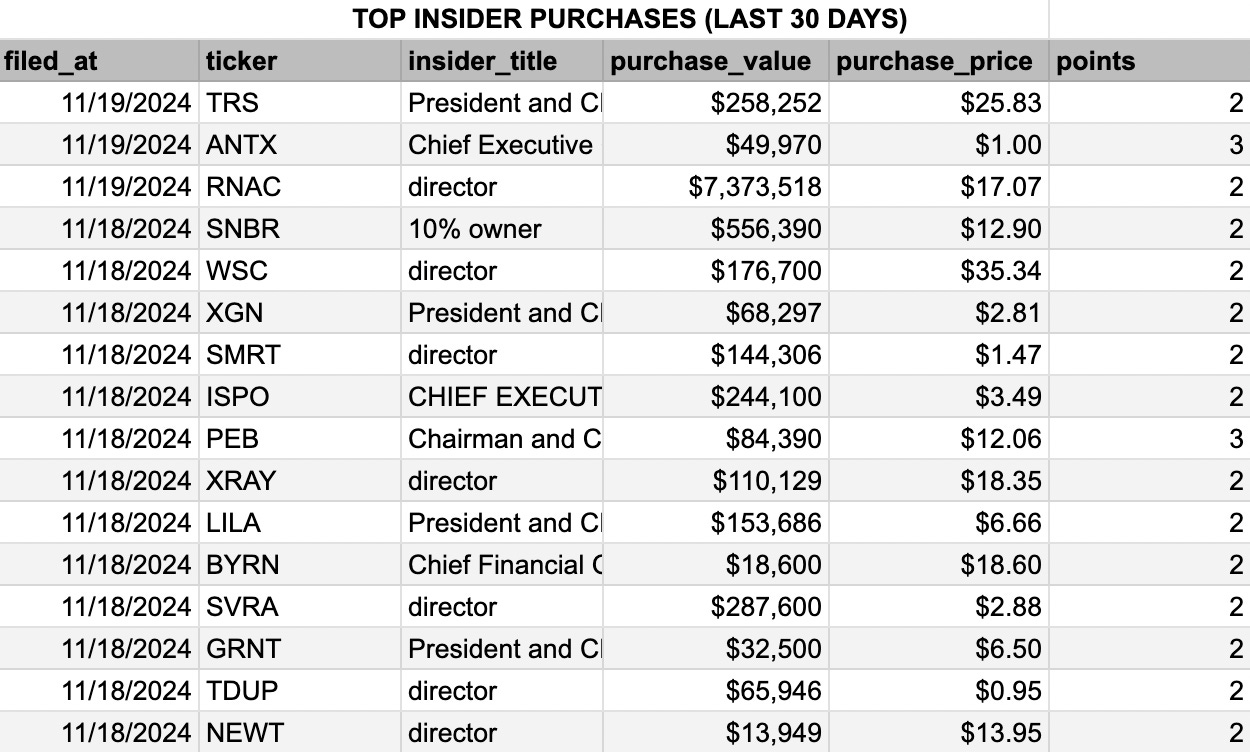

All New Top Purchases

The top purchases made by insiders yesterday. Remember, returns and win rates are calculated using the previous purchase trades by the insider.

Repeat purchases at SNBR, PEB, and XRAY, and first Top Purchases everywhere else:

TRS – President and CEO Purchase

Historical Avg Returns: 10% (1 month) / 12% (3 months)

The President and CEO at TRS has consistently delivered 10% one-month returns and 12% three-month returns across seven prior purchases. This insider’s history demonstrates confidence in tactical buying aligned with short- to mid-term stock performance. TRS operates in a capital-intensive sector, where insider activity often reflects optimism about operational efficiencies or favorable macroeconomic trends. Investors should keep an eye on upcoming earnings or market updates that could reinforce this insider's strategic timing. (Link)

ANTX – Chief Executive Officer Purchase

Historical Avg Returns: 36% (1 month) / 54% (3 months)

The CEO at AN2 Therapeutics, Inc. ($ANTX) showcases an outstanding track record, achieving 36% average one-month returns and 54% three-month returns on a prior purchase. This rare insider activity likely signals confidence in a significant upcoming catalyst, such as clinical trial results or regulatory news. With ANTX operating in a high-growth biotech sector, this purchase is a compelling signal of anticipated value creation. Subscribers may want to monitor announcements closely. (Link)

RNAC – Director Purchase

Historical Avg Returns: 11% (1 month) / 11% (3 months)

The director at RNAC has maintained steady 11% average returns over both one and three months from 30 prior transactions. This consistent track record suggests disciplined buying, likely based on internal knowledge of strategic developments or favorable market positioning. Investors might consider RNAC a stable mid-term opportunity, with additional upside linked to broader market trends. (Link)

SNBR – 10% Owner Purchase

Historical Avg Returns: 4% (1 month) / 11% (3 months)

The 10% Owner at Sleep Number Corp. ($SNBR) averages 4% one-month returns and 11% three-month returns over 11 prior purchases. This insider’s activity often aligns with consumer-driven rebounds, particularly during periods of cyclical recovery in discretionary spending. Sleep Number’s recent movements could make this purchase a short-term momentum play. (Link)

TDUP – Director Purchase

Historical Avg Returns: 16% (1 month) / 20% (3 months)

The director at ThredUp Inc. ($TDUP) boasts impressive 16% one-month and 20% three-month returns from three prior buys. These returns highlight the insider’s ability to capitalize on growth in the online resale sector, which is benefiting from heightened interest in sustainable shopping. Investors should watch for operational updates or partnerships that could amplify near-term returns. (Link)

WSC – Director Purchase

Historical Avg Returns: 8% (1 month) / 12% (3 months)

The director at WillScot Mobile Mini Holdings Corp. ($WSC) averages 8% one-month and 12% three-month returns over four previous purchases. This performance aligns with growth in the modular space and storage solutions industry, suggesting the insider anticipates favorable developments in demand or operational scalability. (Link)

XGN – President and CEO Purchase

Historical Avg Returns: -2% (1 month) / 19% (3 months)

The President and CEO at Exagen Inc. ($XGN) has shown mixed results, with -2% one-month returns but an impressive 19% average over three months across two prior purchases. This pattern suggests the insider is targeting longer-term recovery opportunities, likely tied to operational turnaround efforts in the diagnostics sector. (Link)

PEB – Chairman and CEO Purchase

Historical Avg Returns: 6% (1 month) / 9% (3 months)

The Chairman and CEO at Pebblebrook Hotel Trust ($PEB) averages 6% one-month returns and 9% three-month returns from 23 past purchases. The hospitality sector’s cyclical nature suggests this insider sees potential in post-pandemic recovery trends or favorable asset repositioning efforts. (Link)

SVRA – Director Purchase

Historical Avg Returns: 10% (1 month) / 10% (3 months)

The director at Savara Inc. ($SVRA) consistently achieves 10% average returns over one and three months across 32 transactions. This stable performance reflects confidence in incremental progress within the healthcare sector, likely tied to pipeline advancements or regulatory clarity. (Link)

ISPO – Chief Executive Officer Purchase

Historical Avg Returns: 15% (1 month) / 10% (3 months)

The CEO at Inspirato Inc. ($ISPO) averages 15% one-month returns and 10% three-month returns from two prior purchases. This insider activity suggests confidence in short-term catalysts, such as subscriber growth or new product launches, within the premium travel and hospitality sector. (Link)

NEWT – Director Purchase

Historical Avg Returns: 7% (1 month) / 12% (3 months)

The director at NewtekOne, Inc. ($NEWT) has a strong track record, averaging 7% one-month returns and 12% three-month returns across 21 prior purchases. This insider’s timing indicates optimism in the financial services sector’s ability to navigate current economic headwinds. (Link)

Other notable stocks with less remarkable patterns:

- 6% 1m / 10% 3m avg returns on 5 previous purchases for the Chief Financial Officer at BYRN (Link)

- 5% 1m / 4% 3m avg returns on 7 previous purchases for the President and CEO at GRNT (Link)

- 3% 1m / 9% 3m avg returns on 29 previous purchases for the director at XRAY (Link)

- -1% 1m / 13% 3m avg returns on 17 previous purchases for the director at SMRT (Link)

- 9% 1m / 7% 3m avg returns on 15 previous purchases for the President and CEO at LILA (Link)

Click here to access the spreadsheet (it has many more trades, links to all of the trades, and return calculations for each trade)

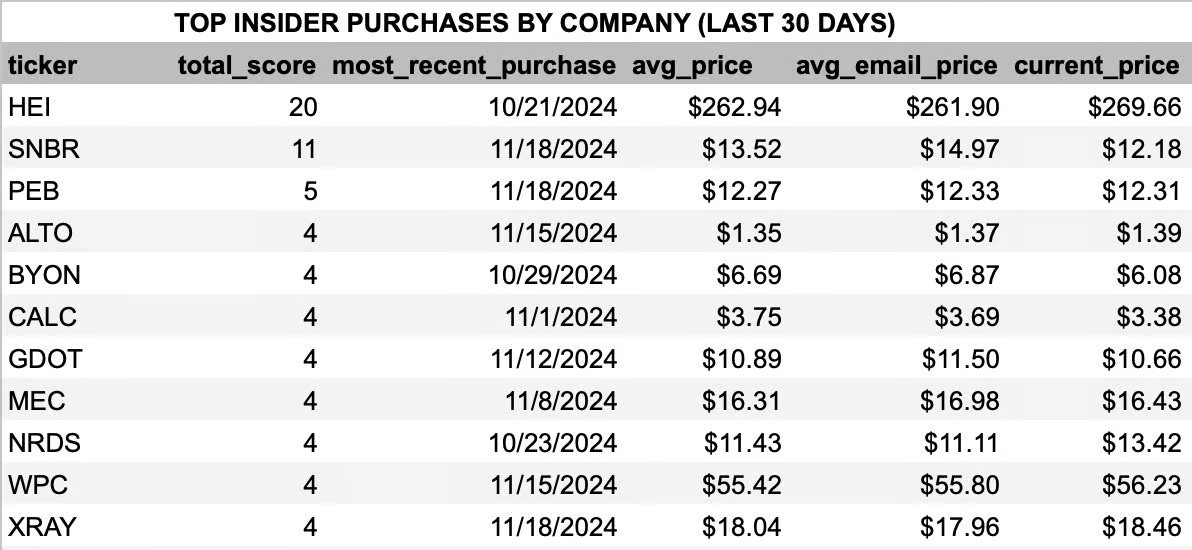

Top Purchases by Company

The companies with the most top insider purchases in the last 30 days.

PEB jumped up to 3rd place after the 3-point purchase today, and XRAY also joined the Top Company list.

Click here to access the spreadsheet (it has many more rows and more return calculations for each row).