Good Afternoon!

Insider trades can reveal valuable insights into where executives and insiders see potential. By analysing recent activity, I've uncovered a few standout opportunities that could offer promising returns.

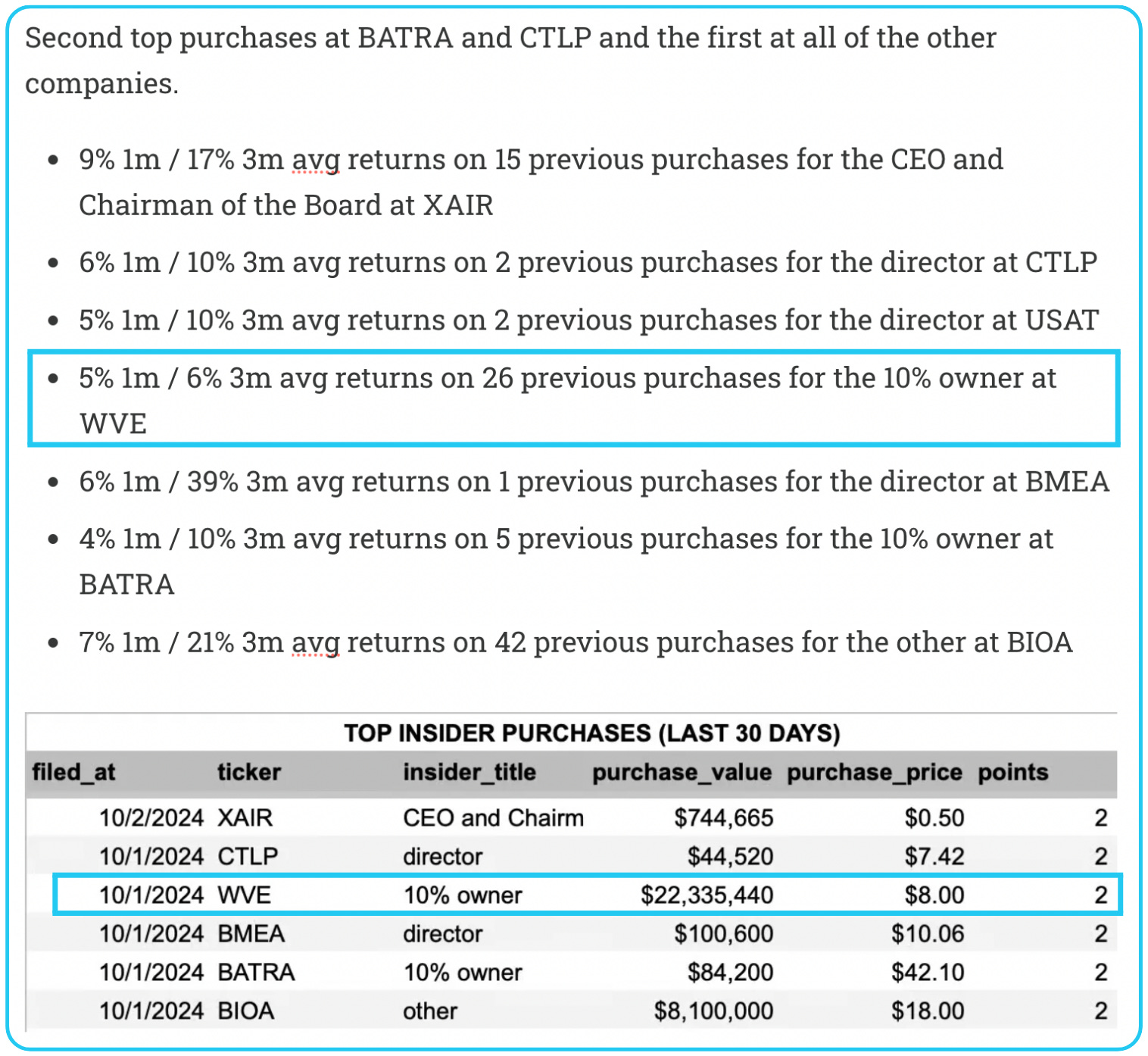

After sifting through 266 insider trades, I’ve calculated which ones show the most promise, and here’s what I found:

- $WVE: Up 73% in 6 weeks after insider activity

- $SATS: Chairman makes a $43M 3-point purchase

- And more...

I’ll keep digging into the data to bring you the latest and most actionable insider moves every day.

Have a fantastic day!

Jack

P.S. Click here for the Google Sheet with all of the data for the last 30 days.

💰 Previous Winner

WVE's stock has risen 73% in just six weeks, driven by a significant Top Purchase by a director involving over $22 million, as mentioned in our October 2nd email. The rally aligns with a series of positive developments for Wave Life Sciences, including a breakthrough in RNA editing technology, which has fueled investor optimism about the company’s innovative approach to genetic disease treatments. Additionally, analysts raised their price targets during this period, reflecting increased confidence in the stock's potential upside. Notably, institutional and insider ownership of WVE remains high, signaling strong faith in its long-term growth prospects. Stocks from that same email are up an average of 17%.

It opened at $8.68 and is up to $15 (+73%).

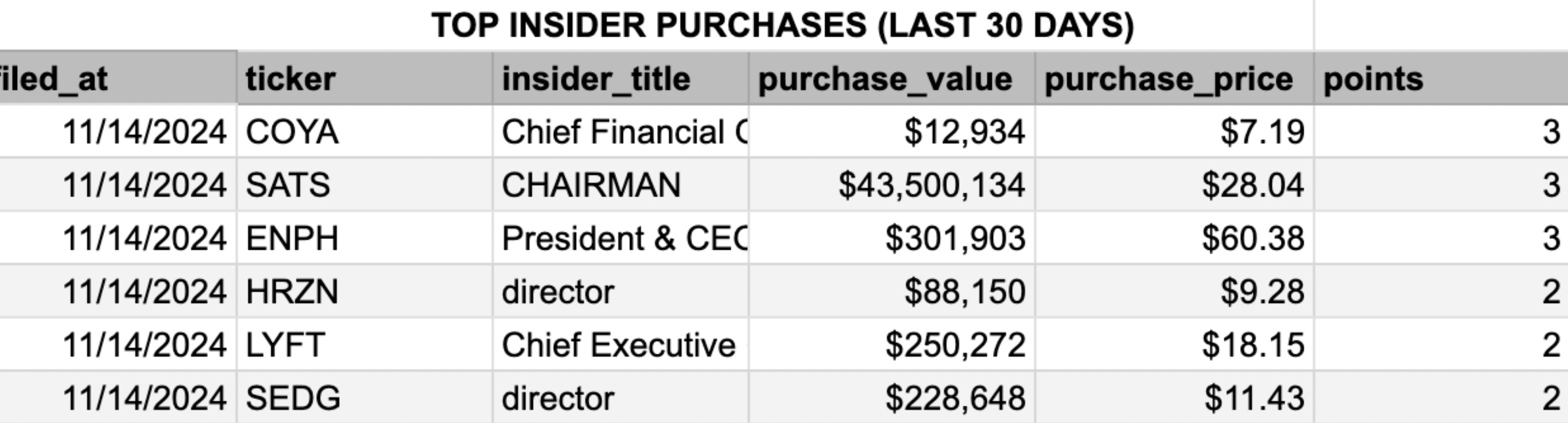

New 3-Point Purchases

3-point purchases are the highest-rated insider trades. Remember, returns and win rates are calculated using the previous purchase trades by the insider.

CFO Purchase at Coya Therapeutics, Inc. ($COYA)

The Chief Financial Officer (CFO) of Coya Therapeutics recently acquired 1,800 shares at $7.19 per share, totaling $12,934.44. This purchase increased the CFO's vested holdings by a substantial 25.7%. Notably, this transaction ranks as their 3rd-largest purchase to date, with a median historical purchase size of $25,591. The current share price stands at $6.81, reflecting a 5.2% decline from the insider’s purchase price. Despite the modest size of this purchase, its context within the CFO's limited transaction history warrants closer scrutiny.

Why This Purchase Stands Out

The CFO’s increased holdings by 25.7% suggest strong confidence in the company’s near-term prospects. While the total purchase size is smaller than their median historical purchase, this buy comes amid a broader market pullback for $COYA. The insider’s decision to acquire shares during this dip reflects optimism regarding the company’s resilience and future trajectory.

Moreover, historical insider performance for $COYA insiders has demonstrated strong outcomes. Purchases by company insiders have historically yielded:

- 1-Month Returns: Weighted average of 22%, with a median of 27%, and a 50% win rate.

- 3-Month Returns: Weighted average of 54%, with a median of 63%, and a 50% win rate.

- 6-Month Returns: Weighted average of 20%, with a median of 25%, and a 50% win rate.

- 1-Year Returns: Weighted average of 81%, with a median of 86%, and a 100% win rate.

These figures highlight the long-term profitability of insider transactions within Coya Therapeutics, making this purchase potentially significant for investors seeking strong returns.

Technical Analysis and Price Action

From a technical perspective, $COYA currently trades 5.2% below the insider’s purchase price. This discount aligns with a recent broader market pullback within the biotechnology sector, driven by macroeconomic headwinds and investor rotation out of high-growth stocks. The $6.80 range aligns with historical support levels, indicating potential downside protection at current prices.

Volume analysis shows an uptick in trading activity near these levels, signaling growing market interest. Moreover, technical indicators such as the Relative Strength Index (RSI) currently hover near oversold levels, suggesting that bearish momentum may be waning. A rebound from these levels could see the stock retest its short-term moving averages, which have previously acted as resistance.

Historical Insider Behavior and Broader Context

The CFO’s historical transactions at $COYA have been limited, but their prior purchases yielded a remarkable 86% median 1-year return and a perfect win rate. Such performance, combined with the relatively high increase in their holdings, underscores a potentially bullish signal. Insider purchases of this nature often indicate anticipation of positive developments, whether tied to clinical trial milestones, regulatory approvals, or partnership announcements.

On a broader scale, $COYA operates in the biotechnology sector, known for its high volatility and event-driven price movements. Recent advancements in precision medicine and immune-modulating therapies have sparked renewed investor interest in niche biotech companies like Coya. The insider’s purchase may hint at confidence in the company’s pipeline or upcoming catalysts.

Summary

This CFO purchase at $COYA, while modest in size, carries weight due to the substantial increase in vested holdings and strong historical insider performance. With $COYA trading near support levels and historical insider purchases yielding high returns, this transaction signals potential upside. Investors should monitor upcoming developments within Coya’s pipeline, as any positive news could catalyze a rebound from current levels.

This transaction is a key example of how insider confidence can serve as a predictive signal for stock performance, especially within the dynamic biotechnology sector. (Link)

Chairman Purchase at EchoStar Corp. ($SATS)

The Chairman of EchoStar Corp. recently executed a major transaction, acquiring 1,551,360 shares at $28.04 per share for a total of $43.50 million. This purchase increased the Chairman's vested holdings by 10.7%, making it their largest purchase to date out of three lifetime transactions. The current share price sits at $21.99, reflecting a 21.6% decline from the insider's entry point. While this purchase comes at a significant premium to the current price, its size and context highlight a strong signal of confidence in the company’s potential future growth.

Why This Purchase Stands Out

The scale of this purchase is noteworthy, as it is nearly 3x larger than the Chairman's median purchase size of $15.72 million. Such a significant investment often reflects heightened conviction in the company's long-term prospects. Despite the stock trading below the purchase price, the Chairman's historical track record with insider transactions at $SATS has been impressive, with consistent 100% win rates across all timeframes:

- 1-Month Returns: Weighted average of 13%, with a median of 14%.

- 3-Month Returns: Weighted average of 12%, with a median of 16%.

- 6-Month Returns: Weighted average of 16%, with a median of 15%.

- 1-Year Returns: Weighted average of 12%, with a median of 17%.

This consistent profitability underscores the reliability of the Chairman's purchases as a bullish indicator for the stock’s potential upside.

Technical Analysis and Price Action

From a technical perspective, $SATS is currently trading at $21.99, a sharp 21.6% drop from the insider’s purchase price of $28.04. The stock's decline coincides with broader market pressures on the communications and satellite technology sector, compounded by investor concerns over near-term operational headwinds. However, the current price aligns with strong historical support levels, suggesting limited downside risk from these levels.

The Relative Strength Index (RSI) currently resides in oversold territory, implying that bearish momentum may be overstretched. Moreover, the stock is trading significantly below its 50- and 200-day moving averages, a scenario that often precedes sharp rebounds, particularly when insider buying signals renewed confidence. If the stock stabilizes near this support zone, a reversal could provide significant upside potential for both short- and long-term investors.

Historical Insider Behavior and Broader Context

The Chairman's prior purchases at $SATS have yielded double-digit returns across all timeframes, with a perfect win rate. The size of this recent transaction suggests that the insider may be anticipating favorable developments, such as strategic business initiatives, partnerships, or operational efficiencies, that could drive future value creation.

EchoStar operates within a highly competitive satellite communications industry. Recent market trends point to growing demand for high-speed, low-latency broadband services, particularly in underserved regions. EchoStar's capabilities in satellite and network solutions position it well to capitalize on these trends. This purchase could reflect the Chairman’s confidence in EchoStar’s ability to enhance its market position and profitability amid these industry tailwinds.

Summary

This purchase by the Chairman of $SATS is significant due to its unprecedented size and the insider’s impeccable historical track record of profitable trades. Although the stock is currently trading at a steep discount to the purchase price, historical performance following similar transactions suggests that this dip could represent a compelling entry point. With $SATS trading near key support levels and insider confidence signaling potential positive catalysts, this transaction stands out as a noteworthy indicator of upside potential in the months ahead. Investors seeking exposure to the satellite communications sector should monitor this insider activity closely. (Link)

All New Top Purchases

The top purchases made by insiders yesterday. Remember, returns and win rates are calculated using the previous purchase trades by the insider.

First Top Purchases at all of these companies:

COYA – Chief Financial Officer Purchase

Historical Avg Returns: 26% (1 month) / 62% (3 months)

The Chief Financial Officer at COYA Therapeutics, Inc. has a stellar track record, with an average return of 26% over one month and an impressive 62% over three months from previous insider purchases. This insider’s performance suggests a strong alignment between their purchase timing and subsequent positive stock movements. The CFO’s 26% one-month return indicates a history of identifying short-term price catalysts, likely tied to operational milestones or favorable news flow.

The three-month return of 62% further reinforces confidence in this insider's ability to capitalize on medium-term growth. This suggests the CFO's decisions are often linked to developments that unfold over a few quarters, such as successful clinical trials, pipeline updates, or partnership announcements. Subscribers may want to monitor COYA closely for signs of similar catalysts, as the CFO’s confidence has historically been a reliable indicator of upside potential. (Link)

SATS – Chairman Purchase

Historical Avg Returns: 13% (1 month) / 15% (3 months)

EchoStar’s Chairman has demonstrated steady returns, with an average of 13% over one month and 15% over three months from past purchases. These figures reflect a consistent, albeit measured, success in identifying entry points that align with favorable market or company dynamics.

The relatively modest but positive returns suggest that the Chairman’s insider activity is more likely linked to long-term strategic moves rather than immediate market speculation. This could include advancements in satellite technologies, strategic partnerships, or new contract wins. Given the insider's historical consistency, this purchase may indicate a belief in EchoStar’s ability to navigate current headwinds and emerge stronger. Investors should pay attention to any upcoming news related to contracts or technological developments that could act as catalysts. (Link)

ENPH – President & CEO Purchase

Historical Avg Returns: 18% (1 month) / 61% (3 months)

The President and CEO of Enphase Energy boasts an outstanding track record, with 18% average one-month returns and 61% average three-month returns on previous insider buys. These figures highlight the CEO’s exceptional ability to anticipate Enphase’s growth trajectory, likely informed by insights into product launches, market expansion, or operational efficiencies.

The 61% three-month return underscores the CEO’s track record of aligning purchases with transformative events that drive sustained value creation. Given Enphase’s leadership in renewable energy solutions, such insider activity could signal confidence in upcoming product innovations or favorable policy developments in clean energy markets. Subscribers should monitor industry news and company announcements, as these may provide further context for this insider’s optimism. (Link)

HRZN – Director Purchase

Historical Avg Returns: 7% (1 month) / 21% (3 months)

The Director at Horizon Technology Finance has shown a history of 7% average one-month returns and 21% average three-month returns, signaling a steady and moderate appreciation tied to insider activity. These returns suggest the director’s purchases are well-timed to align with periodic performance improvements or broader industry trends.

Horizon’s focus on venture debt financing makes it sensitive to changes in market liquidity or emerging growth sectors. The director’s history of achieving 21% three-month returns suggests that insider activity could precede periods of increased lending activity or notable portfolio company successes. This purchase may warrant attention from investors seeking moderate but consistent growth. (Link)

LYFT – Chief Executive Officer Purchase

Historical Avg Returns: 4% (1 month) / 32% (3 months)

The CEO at Lyft has a solid track record of achieving 4% one-month returns and 32% three-month returns, highlighting their ability to time purchases effectively in a volatile ridesharing market. The stark contrast between the one-month and three-month averages suggests that the CEO’s buys often precede strategic developments that take time to materialize, such as regulatory changes, partnerships, or shifts in operational strategy.

Given Lyft’s exposure to competitive pressures and economic conditions, the CEO’s historical performance indicates confidence in a rebound or strategic pivot. Investors should watch for announcements related to cost-cutting measures, market share growth, or new revenue streams, which could justify the CEO’s positive outlook. (Link)

SEDG – Director Purchase

Historical Avg Returns: 6% (1 month) / 13% (3 months)

The Director at SolarEdge Technologies has achieved 6% average one-month returns and 13% average three-month returns, signaling consistent but moderate gains. This return profile suggests the director’s purchases are strategically aligned with periods of operational stability or incremental growth.

As a leading provider of solar energy solutions, SolarEdge’s performance is influenced by trends in renewable energy adoption and global regulatory frameworks. The director’s track record suggests confidence in the company’s ability to navigate these factors. Monitoring sector news or company-specific developments, such as new product launches or market expansion, could provide further context for this insider’s decision. (Link)

Click here to access the spreadsheet (it has many more trades, links to all of the trades, and return calculations for each trade)

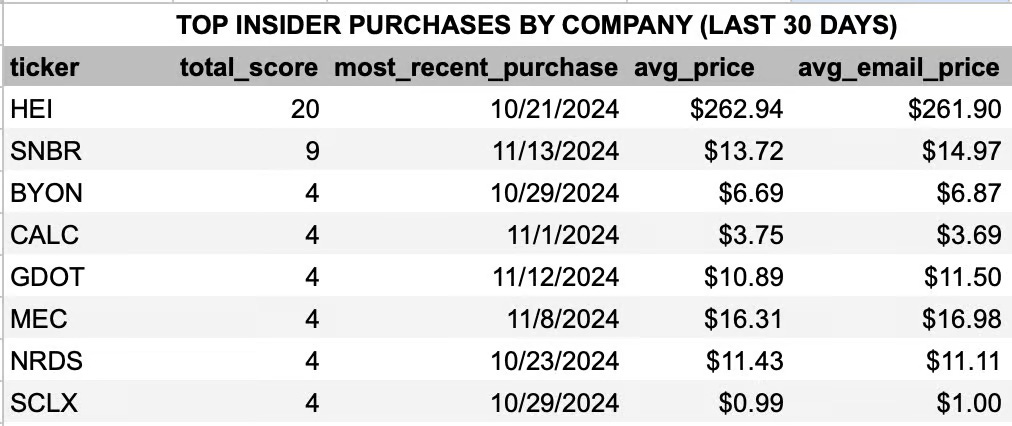

Top Purchases by Company

The companies with the most top insider purchases in the last 30 days.

No changes to the top of the company list.

Click here to access the spreadsheet (it has many more rows and more return calculations for each row).