Note: the SEC is closed for Veterans Day today, so there will be no Boardroom Buys tomorrow because there won’t be any filings made today.

Good Afternoon!

Insider trades can reveal valuable insights into where executives and insiders see potential. By analysing recent activity, I've uncovered a few standout opportunities that could offer promising returns.

Thanks for reading Boardroom Buys! Subscribe for free to receive new posts and support my work.

After sifting through 362 insider trades, I’ve calculated which ones show the most promise, and here’s what I found:

- $SEPN.: Up 28% in two weeks following insider purchase

- Chief Human Resources Officer with 22% 1m returns buys the stock

- And more…

I’ll keep digging into the data to bring you the latest and most actionable insider moves every day.

Have a fantastic day!

Jack

P.S. Click here for the Google Sheet with all of the data for the last 30 days.

💰 Previous Winner

SEPN was a 3-point purchase shared in the October 29th email just under two weeks ago and is already up 28%.

It opened at $20.72 and is up to $25.91.

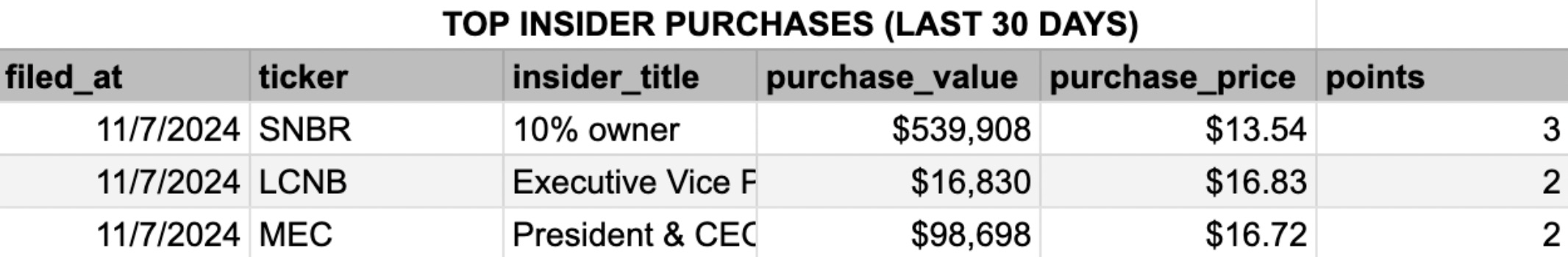

New 3-Point Purchases

3-point purchases are the highest-rated insider trades. Remember, returns and win rates are calculated using the previous purchase trades by the insider.

None today

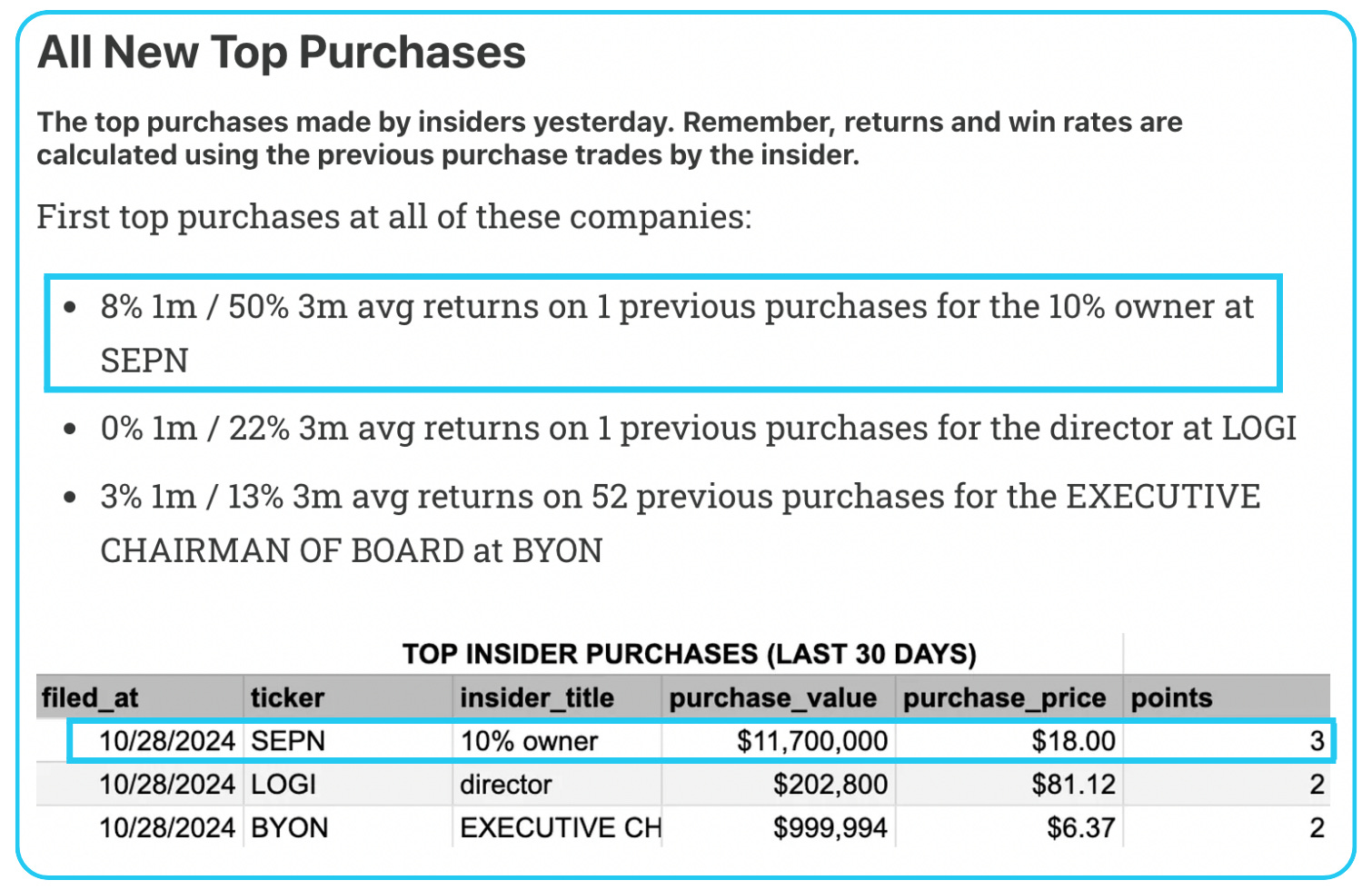

All New Top Purchases

The top purchases made by insiders yesterday. Remember, returns and win rates are calculated using the previous purchase trades by the insider.

Second Top Purchase in the last 30 days at $MEC and the first Top Purchase at CNC and LKFN:

MEC – Chief Human Resources Officer Purchase

Historical Avg Returns: 22% (1 month) / 19% (3 months)

The Chief Human Resources Officer at MEC has shown impressive return potential with a 22% one-month and 19% three-month average on past purchases. Such high short-term returns from insider purchases suggest a strong alignment between the CHRO’s decisions and favorable stock movements, possibly hinting at internal developments or anticipated operational strength. This could indicate that MEC is in a period of accelerated performance or is benefiting from recent strategic moves. This insider’s confidence may be an opportunity to consider MEC’s short-term potential as a prime addition, especially if backed by positive market or company-specific news. (Link)

CNC – Chief Executive Officer Purchase

Historical Avg Returns: 8% (1 month) / 5% (3 months)

The CEO of CNC has a history of reliable, modest returns, with 8% gains on average over one month following trades. Although this purchase does not indicate an aggressive outlook, the CEO’s track record reveals consistency, which could appeal to more conservative investors. CNC’s sector performance and any anticipated regulatory or market catalysts might further enhance the outlook here. Subscribers should consider CNC’s broader market positioning and upcoming announcements as potential value drivers aligned with steady insider confidence. (Link)

LKFN – Director Purchase

Historical Avg Returns: 0% (1 month) / 9% (3 months)

The director’s trades at LKFN show a pattern of longer-term appreciation, with 9% average gains over three months and no immediate return one month after past purchases. This implies that the director may be making strategic, long-view decisions that pay off gradually rather than quickly. Such patterns can appeal to investors who value growth over volatility. For subscribers, examining upcoming quarterly performance or strategic moves by LKFN might reveal further upside, especially if the director's continued interest aligns with positive developments in the regional banking sector. (Link)

Click here to access the spreadsheet (it has many more trades, links to all of the trades, and return calculations for each trade)

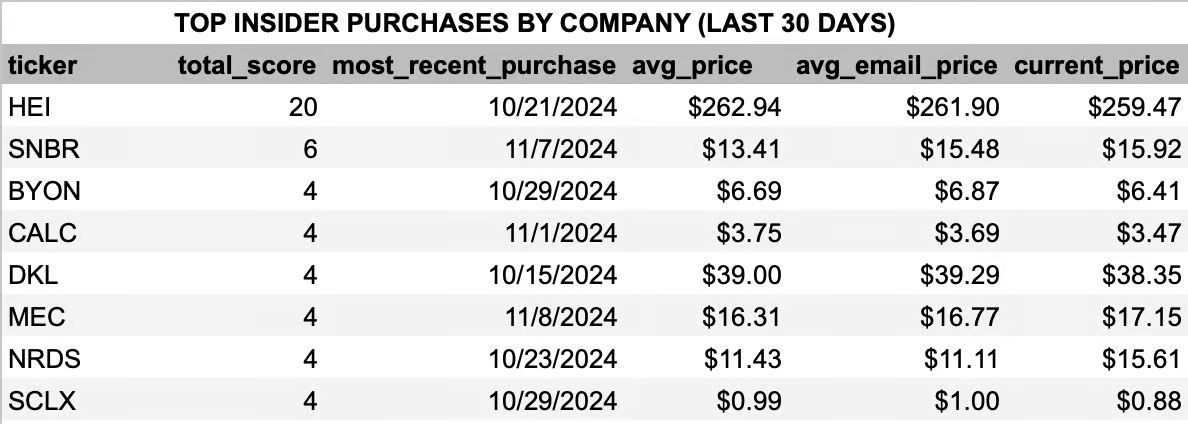

Top Purchases by Company

The companies with the most top insider purchases in the last 30 days.

MEC joins the list after the Top Purchase we found today.

Click here to access the spreadsheet (it has many more rows and more return calculations for each row).

Thanks for reading Boardroom Buys! Subscribe for free to receive new posts and support my work.