Good Afternoon!

Insider trades can reveal valuable insights into where executives and insiders see potential. By analysing recent activity, I've uncovered a few standout opportunities that could offer promising returns.

After sifting through 498 insider trades, I’ve calculated which ones show the most promise, and here’s what I found:

- $TECX: Up 25% in two weeks after CEO’s insider purchase

- $HRTG: CEO buys with 3-point purchase score

- And more…

I’ll keep digging into the data to bring you the latest and most actionable insider moves every day.

Have a fantastic day!

Jack

P.S. Click here for the Google Sheet with all of the data for the last 30 days.

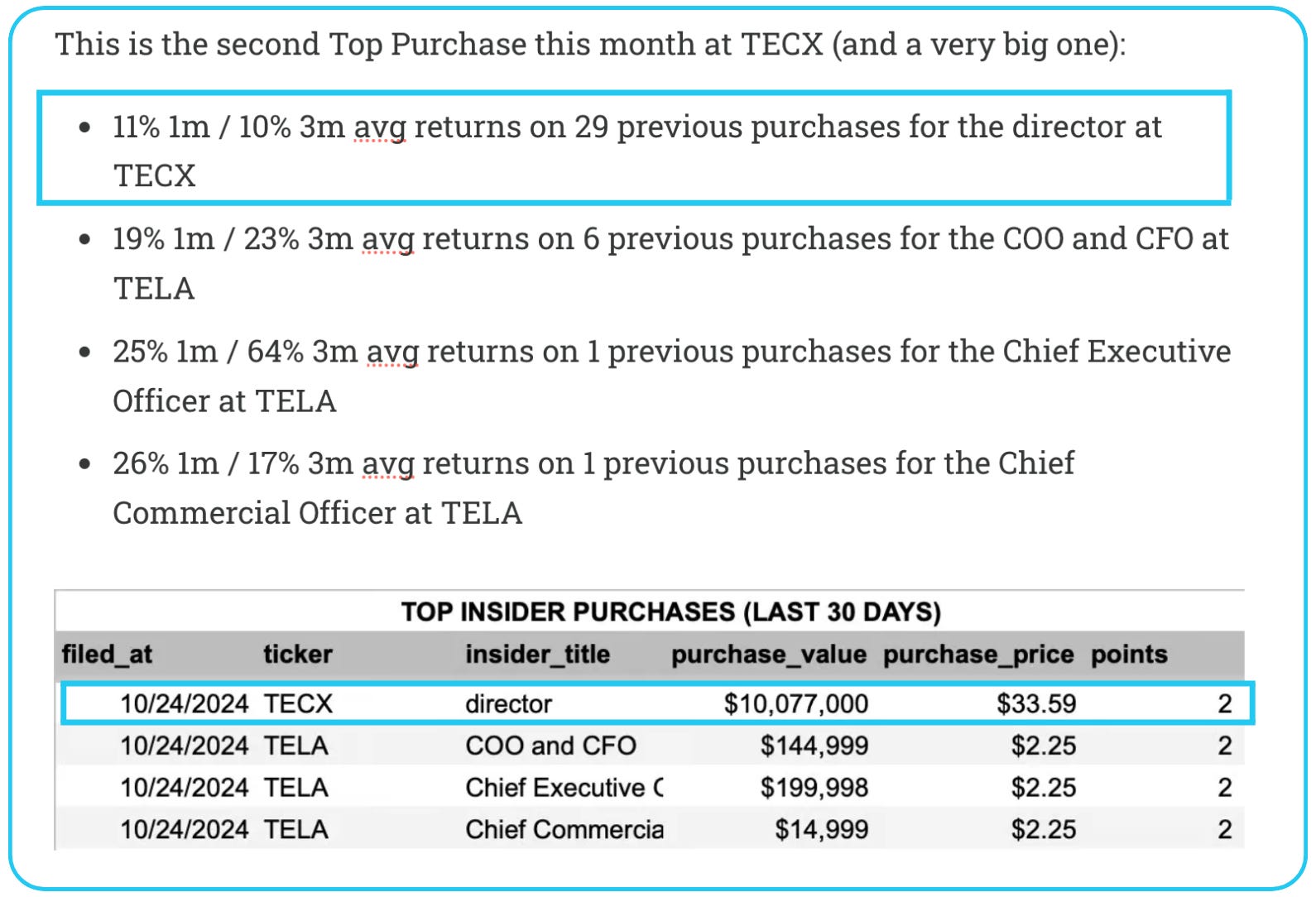

💰 Previous Winner

$TECX has gained 25% in two weeks since we highlighted this top insider purchase in our October 25 email.

It opened at $38.10 and is up to $47.75.

New 3-Point Purchases

3-point purchases are the highest-rated insider trades. Remember, returns and win rates are calculated using the previous purchase trades by the insider.

CEO Purchase at Heritage Insurance Holdings, Inc. ($HRTG)

In a notable insider move, the CEO of Heritage Insurance Holdings ($HRTG) recently bought 3,950 shares at $12.53 per share, totaling $49,493.50. This purchase represents the CEO’s fourth-largest buy to date out of 24 recorded transactions, and it increased their vested holdings by 0.4%. Despite the stock currently trading at $11.83, a 5.6% decline since the purchase, the CEO’s investment signals confidence that could spark a rebound.

Why This Purchase Stands Out

The size of this transaction is more substantial than the CEO’s usual purchases, with a median historical purchase size of just $10,518.40. The larger purchase amount suggests heightened confidence in the company’s future. Executives often hold off on making significant buys unless they see meaningful potential on the horizon, which aligns with Heritage Insurance’s positive return patterns following insider purchases.

Strong Historical Insider Performance at $HRTG

The CEO’s previous trades have a solid track record of positive returns:

- 1-month returns: Weighted average of 12% with a median of 14%, and an impressive 87% win rate (20 out of 23 trades).

- 3-month returns: Weighted average of 21% with a median of 28%, with a 74% win rate (17 out of 23 trades).

- 6-month returns: Weighted average of 36% with a median of 33%, with an 82% win rate (18 out of 22 trades).

- 1-year returns: Weighted average of 79% with a median of 34%, with a 75% win rate (15 out of 20 trades).

These statistics reveal consistent gains over multiple timeframes, demonstrating that the CEO’s trades tend to lead to profitable outcomes. The high win rates, particularly within the 1- and 6-month periods, suggest that insider buys at $HRTG often indicate a strong upside.

Summary

The CEO’s latest purchase at $HRTG aligns with a history of profitable insider trades, hinting at confidence in the company's near- and long-term potential. Although the current price is slightly below the CEO’s purchase price, the stock’s historical performance following similar transactions suggests this dip may represent a buying opportunity for investors seeking potential gains over the coming months.

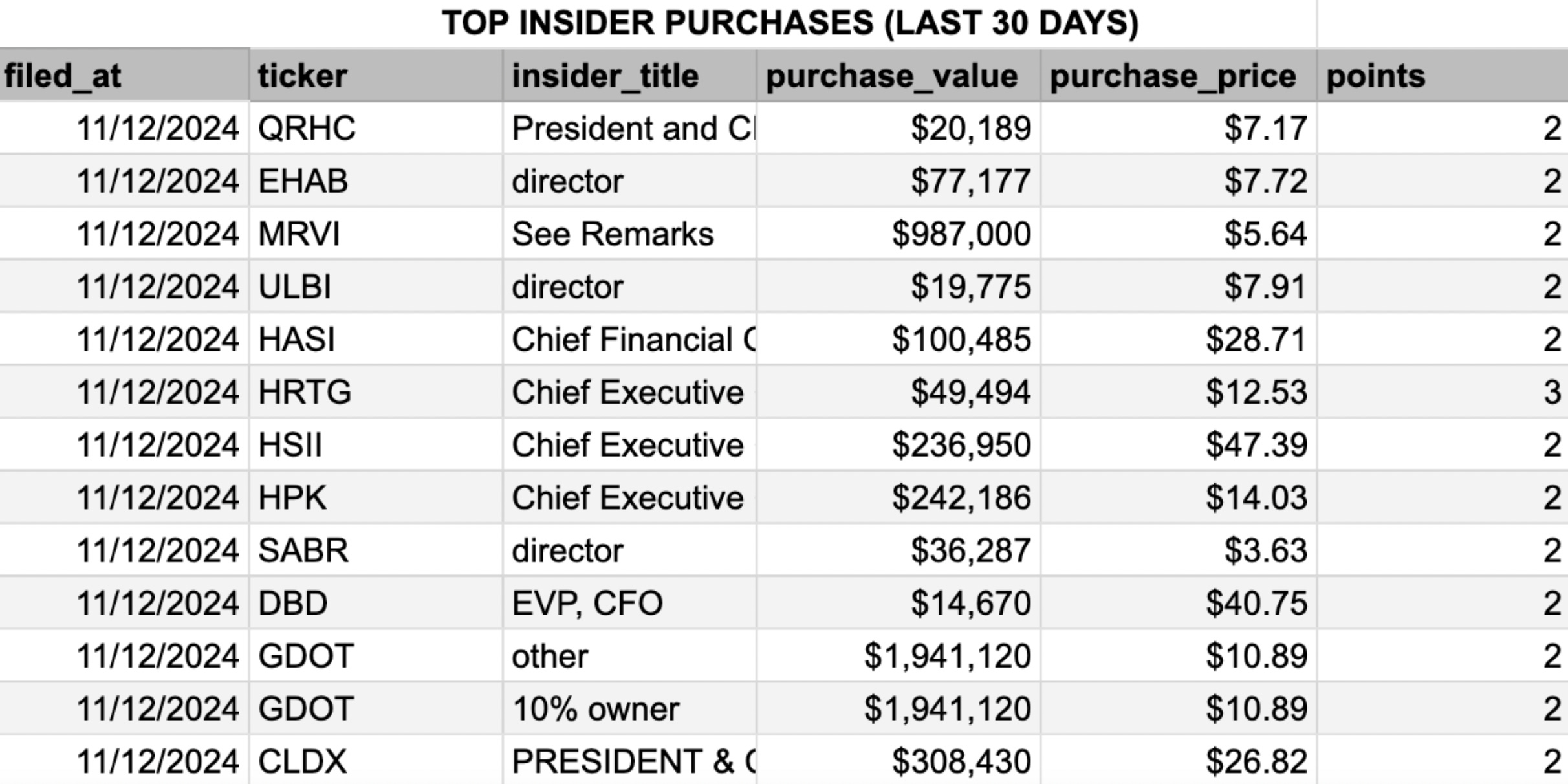

All New Top Purchases

The top purchases made by insiders yesterday. Remember, returns and win rates are calculated using the previous purchase trades by the insider.

It was the first Top Purchase at all of these companies:

QRHC – President and CEO Purchase

Historical Avg Returns: 2% (1 month) / 30% (3 months)

The President and CEO at QRHC has a strong history of higher returns over the three-month mark, with an average gain of 30%. Although one-month returns have been modest at 2%, this executive’s longer-term confidence has often paid off. This top purchase could indicate a strategic position aligning with positive operational developments or expected company growth. Subscribers may want to monitor QRHC for news or performance updates that align with this executive’s established, longer-term return profile. (Link)

EHAB – Director Purchase

Historical Avg Returns: 4% (1 month) / 5% (3 months)

The director at EHAB has shown steady, if modest, returns on insider purchases, averaging 4% over one month and 5% over three months. This suggests a conservative but positive outlook, hinting that incremental gains may align with consistent performance in EHAB’s market segment. Investors seeking steadier returns may find this insider’s activity a reasonable indicator of stable value. Any additional news or earnings guidance could further enhance the potential for measured gains here. (Link)

MRVI – “See Remarks” Purchase

Historical Avg Returns: 0% (1 month) / 15% (3 months)

MRVI’s insider has shown a preference for gradual growth with average gains of 15% over three months. This pattern suggests a strategic, longer-term approach, where value builds over time rather than immediately. For investors focused on a moderate timeframe, this purchase could signal potential appreciation aligned with operational developments or market trends that favor MRVI’s sector. Tracking upcoming reports or relevant industry news may reveal supportive trends. (Link)

ULBI – Director Purchase

Historical Avg Returns: 6% (1 month) / 8% (3 months)

The director at ULBI has demonstrated a modest but stable return pattern, with average gains of 6% over one month and 8% over three months. This steady performance reflects a measured approach that could appeal to investors seeking low-volatility opportunities. Observing ULBI’s next earnings or strategic announcements may indicate if this insider’s confidence aligns with a broader, gradual growth trend. (Link)

HASI – Chief Financial Officer Purchase

Historical Avg Returns: 6% (1 month) / 9% (3 months)

The CFO’s trades at HASI show consistent gains, averaging 6% over one month and 9% over three months. This conservative yet positive insider history may indicate operational confidence, possibly supported by the CFO’s insight into the company’s financial health. Subscribers should consider this purchase within the broader context of HASI’s market performance and sector trends. (Link)

HRTG – Chief Executive Officer Purchase

Historical Avg Returns: 14% (1 month) / 28% (3 months)

HRTG’s CEO has a track record of impressive returns, averaging 14% over one month and 28% over three months. This substantial performance reflects a history of successful timing and possible strategic insight. Subscribers may want to consider the potential for similar returns on this recent buy, especially if HRTG is poised for favorable news or operational momentum. (Link)

HSII – Chief Executive Officer Purchase

Historical Avg Returns: 4% (1 month) / 12% (3 months)

The CEO at HSII has historically achieved moderate returns with a steady 4% gain over one month and 12% over three. This track record might appeal to investors favoring consistent but gradual appreciation. Monitoring industry news and company announcements could provide further clarity on whether this purchase signals continued stable growth. (Link)

HPK – Chief Executive Officer Purchase

Historical Avg Returns: 8% (1 month) / 16% (3 months)

The CEO’s purchase history at HPK indicates a pattern of growth, with average gains of 8% over one month and 16% over three. This trend suggests potential short-term opportunities, especially if aligned with positive operational or market developments. For subscribers, staying attuned to HPK’s upcoming updates may provide valuable insights. (Link)

SABR – Director Purchase

Historical Avg Returns: 21% (1 month) / 19% (3 months)

The director at SABR has shown impressive short-term returns, with an average of 21% over one month. This return profile indicates potential for rapid appreciation following purchases, possibly hinting at favorable shifts within the company. Subscribers may consider SABR’s near-term announcements or performance catalysts as an opportunity for capitalizing on this insider’s confidence. (Link)

DBD – EVP, CFO Purchase

Historical Avg Returns: 8% (1 month) / 32% (3 months)

The CFO at DBD has achieved notable returns on previous trades, averaging 8% over one month and 32% over three months. This strong three-month return pattern may signal confidence in DBD’s operational or strategic initiatives. Investors focused on medium-term growth could find this insider purchase particularly promising, especially in light of upcoming company updates. (Link)

GDOT – “Other” & 10% Owner Purchases

Historical Avg Returns: 14% (1 month) / 66% (3 months)

At GDOT, both an “Other” insider and a 10% owner have consistently delivered substantial returns, with average gains of 14% over one month and 66% over three months. These figures point to high confidence and a strong outlook for GDOT’s future. Subscribers should monitor GDOT’s next financial report or strategic moves, which could reveal further opportunities aligned with this insider’s proven success. (Link) (Link)

CLDX – President & CEO Purchase

Historical Avg Returns: 67% (1 month) / 60% (3 months)

The CEO at CLDX has achieved exceptional returns, with a staggering 67% average over one month and 60% over three months. This remarkable track record speaks to the insider’s strategic foresight and potential knowledge of upcoming developments. For subscribers, CLDX represents a prime candidate for short-term gains if recent company actions support these substantial returns. (Link)

Click here to access the spreadsheet (it has many more trades, links to all of the trades, and return calculations for each trade)

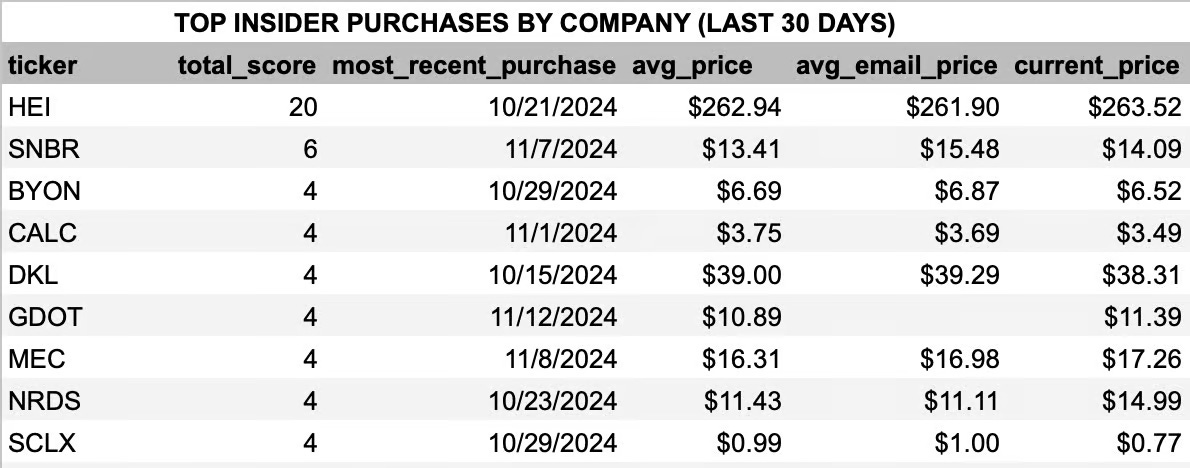

Top Purchases by Company

The companies with the most top insider purchases in the last 30 days.

GDOT joined the top of the Company list with today’s Top Purchase.

Click here to access the spreadsheet (it has many more rows and more return calculations for each row).