Good Afternoon!

Insider trades can reveal valuable insights into where executives and insiders see potential. By analysing recent activity, I've uncovered a few standout opportunities that could offer promising returns.

After sifting through 328 insider trades, I’ve calculated which ones show the most promise, and here’s what I found:

- $TWFG: Up 40% following insider buys

- $SNBR: Another 3-point purchase shows bullish trend

- And more…

I’ll keep digging into the data to bring you the latest and most actionable insider moves every day.

Have a fantastic day!

Jack

P.S. Click here for the Google Sheet with all of the data for the last 30 days.

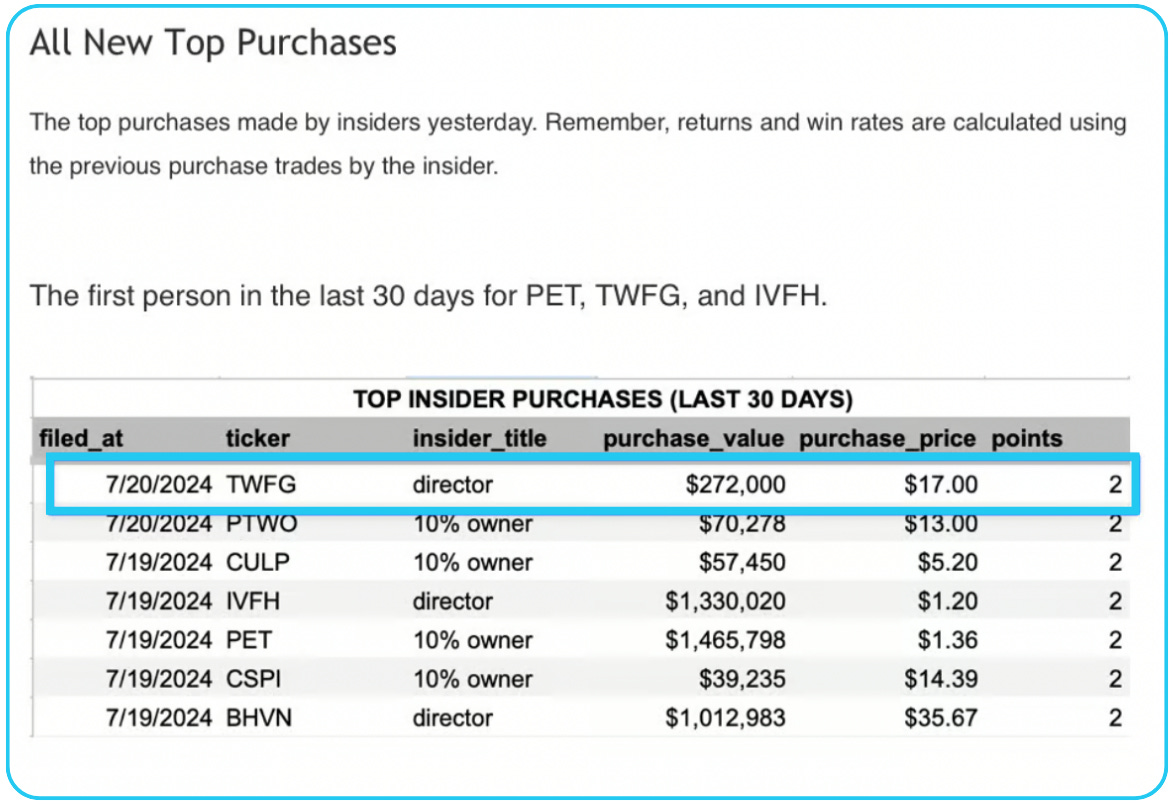

💰 Previous Winner

TWFG is up 40% since we featured it in the August 22nd Premium email, where we noted a top insider buying $272k worth of the stock.

It opened at $22.50 on Thursday, August 22, and is up to $31.61 (+40%).

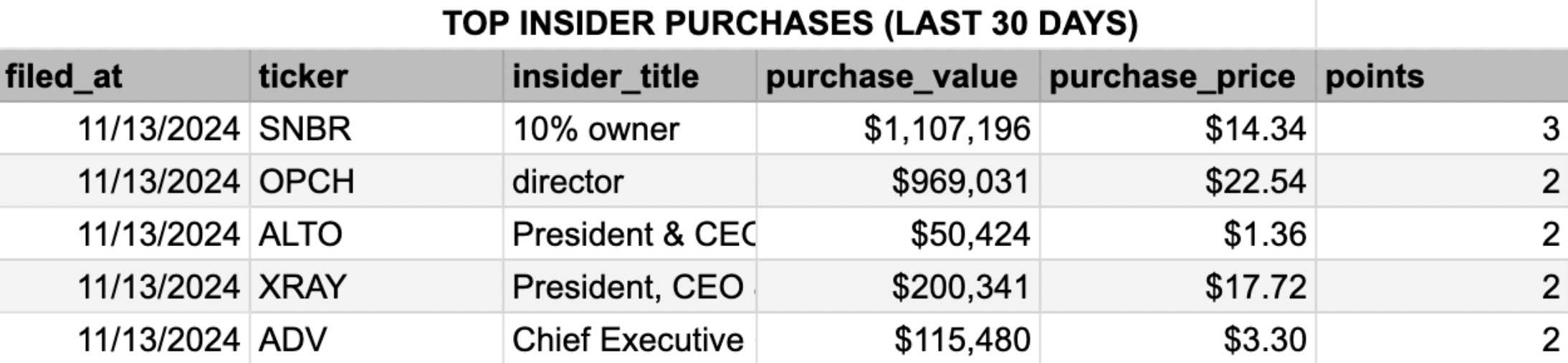

New 3-Point Purchases

3-point purchases are the highest-rated insider trades. Remember, returns and win rates are calculated using the previous purchase trades by the insider.

10% Owner Purchase at Sleep Number Corp. ($SNBR)

In a significant transaction, a 10% Owner at Sleep Number Corp. ($SNBR) acquired 77,185 shares at $14.34 per share, for a total of $1.11 million. This purchase marks their third-largest to date, boosting their vested holdings by 3.1%. The current stock price sits at $13.82, a 3.7% dip from the insider’s entry point. Given the size of this purchase and the owner’s historical track record, this transaction may signal strong confidence in Sleep Number's potential rebound and growth.

Why This Purchase Stands Out

The transaction size here is more than double this insider’s typical median purchase of $497,000, underscoring an unusual level of conviction. This level of investment suggests that the 10% Owner anticipates a shift in the company's trajectory, making this buy a departure from their usual purchasing pattern. Such large insider purchases often indicate heightened expectations about the company’s long-term outlook, especially from a substantial shareholder who holds a considerable stake in the company’s future.

Technical Analysis and Price Positioning

The current price of $13.82 places the stock below the insider’s purchase price of $14.34, a decrease of 3.7%. Historically, when insiders at Sleep Number have made substantial buys during similar price dips, the stock has often rebounded strongly in the following months. Additionally, the stock’s current price aligns closely with recent support levels, suggesting a potential floor that may encourage buyers to step in. If the stock holds at this level and shows signs of upward momentum, this insider purchase could serve as a catalyst for renewed interest.

Furthermore, this purchase comes as the stock hovers near its 52-week low, a point where historically strong reversals have occurred following insider buying at Sleep Number. Technical indicators, such as the Relative Strength Index (RSI), currently sit in oversold territory, which may signal a buying opportunity for those looking to capitalize on a potential rebound.

Strong Historical Insider Performance at $SNBR

Examining this insider’s historical performance reveals a pattern of positive returns following previous transactions, with a high probability of success over various timeframes:

- 1-Month Returns: Weighted average of 4%, median of 5%, and a remarkable 88% win rate (7 out of 8 trades), indicating short-term gains are highly probable following similar purchases.

- 3-Month Returns: Although the weighted average is slightly negative at -3%, the median 3-month return stands at 11%, with a 50% win rate. This mixed outcome suggests the stock’s path to profitability may vary at the 3-month mark but often remains positive overall.

- 6-Month Returns: Weighted average of 14% and a median of 11%, with a win rate of 75% (6 out of 8 trades). These statistics show that the insider’s trades often correlate with sustained gains over half a year.

- 1-Year Returns: Weighted average of 31%, median of 48%, and an 88% win rate (7 out of 8 trades), highlighting a consistent record of long-term profitability.

The high win rates, especially within the 1- and 6-month timeframes, indicate that insider purchases at Sleep Number have historically been effective signals of potential upside. This pattern aligns with the stock’s tendency to perform well following significant insider purchases, lending weight to this recent transaction as a positive indicator.

Broader Market and Industry Context

Sleep Number operates within a volatile industry that can be impacted by macroeconomic trends, such as consumer spending and inflation. However, the significant insider activity suggests confidence that the company may outperform these headwinds. Notably, past insider buys at similar economic inflection points have frequently led to above-average gains, likely due to Sleep Number’s ability to adapt within a cyclical market. Additionally, industry trends around personalized and health-oriented sleep solutions have shown growth potential, which could position Sleep Number favorably.

Summary

This insider purchase at $SNBR is noteworthy due to its size and the 10% Owner’s established history of profitable trades. Although the stock’s price is slightly below the purchase price, historical performance following similar insider buys suggests this dip could represent a favorable entry point. Combined with the technical support at its current level and the broader industry trends, this transaction may indicate positive momentum for Sleep Number Corp. in the coming months, making it a potential buying opportunity for investors looking for upside in a challenging market environment. (Link)

All New Top Purchases

The top purchases made by insiders yesterday. Remember, returns and win rates are calculated using the previous purchase trades by the insider.

It was the first Top Purchase at all of these companies except SNBR:

SNBR – 10% Owner Purchase

Historical Avg Returns: 5% (1 month) / 11% (3 months)

The 10% Owner at Sleep Number Corp. ($SNBR) has a history of consistent gains, averaging 5% over one month and 11% over three months from 10 prior purchases. This insider’s buying activity aligns closely with company stock performance in the short- to mid-term, suggesting confidence in Sleep Number’s near-term trajectory. Notably, Sleep Number operates in the discretionary consumer sector, where insider activity has often correlated with price movements due to shifts in consumer sentiment. Subscribers may wish to monitor SNBR’s next quarterly earnings for indications of growth momentum that align with the insider’s strategic purchase timing. (Link)

OPCH – Director Purchase

Historical Avg Returns: 10% (1 month) / 4% (3 months)

The director at Option Care Health, Inc. ($OPCH) has historically averaged 10% returns over one month and 4% over three months from four prior purchases. The director’s pattern of buying aligns with shorter-term performance, possibly indicating a tactical approach to insider purchases. OPCH operates in the healthcare sector, which tends to be sensitive to regulatory and reimbursement developments; any favorable policy shifts could amplify returns in line with this insider’s short-term profile. Investors should consider this purchase as a signal of potential upside in the near term, particularly if sector dynamics remain favorable. (Link)

ALTO – President & CEO Purchase

Historical Avg Returns: 9% (1 month) / 2% (3 months)

The President and CEO of Alto Ingredients, Inc. ($ALTO) has seen average returns of 9% over one month and 2% over three months on five prior purchases, suggesting an opportunistic approach favoring shorter-term gains. ALTO operates in the volatile biofuels sector, where regulatory incentives and market demand for alternative energy can lead to rapid price shifts. With the CEO’s timing indicating potential for short-term appreciation, subscribers may want to watch for any industry updates, such as government incentives or pricing shifts, that could complement the insider’s purchase pattern. (Link)

XRAY – President, CEO & Member of the Board Purchase

Historical Avg Returns: 13% (1 month) / 12% (3 months)

At Dentsply Sirona Inc. ($XRAY), the President and CEO has achieved 13% average returns over one month and 12% over three months on a single prior purchase, suggesting a strong correlation between insider activity and positive price movement. Given that XRAY is a dental technology firm with revenue tied to healthcare spending and product innovation, this insider’s buy could indicate confidence in upcoming product launches or market expansion. Subscribers may want to track industry announcements, as alignment with innovation milestones could enhance the likelihood of replicating these returns. (Link)

ADV – Chief Executive Officer Purchase

Historical Avg Returns: 12% (1 month) / 21% (3 months)

The CEO of Advantage Solutions Inc. ($ADV) has a robust history of returns, averaging 12% over one month and 21% over three months from 12 previous buys. This performance points to an insider with strong strategic foresight and the ability to time purchases effectively in the consulting and solutions industry. Given the cyclical nature of the consulting market, this buy could imply an expectation of favorable client expansion or contract renewals. Investors may wish to monitor contract announcements or sector trends that could lead to positive performance in line with the insider’s record. (Link)

Click here to access the spreadsheet (it has many more trades, links to all of the trades, and return calculations for each trade)

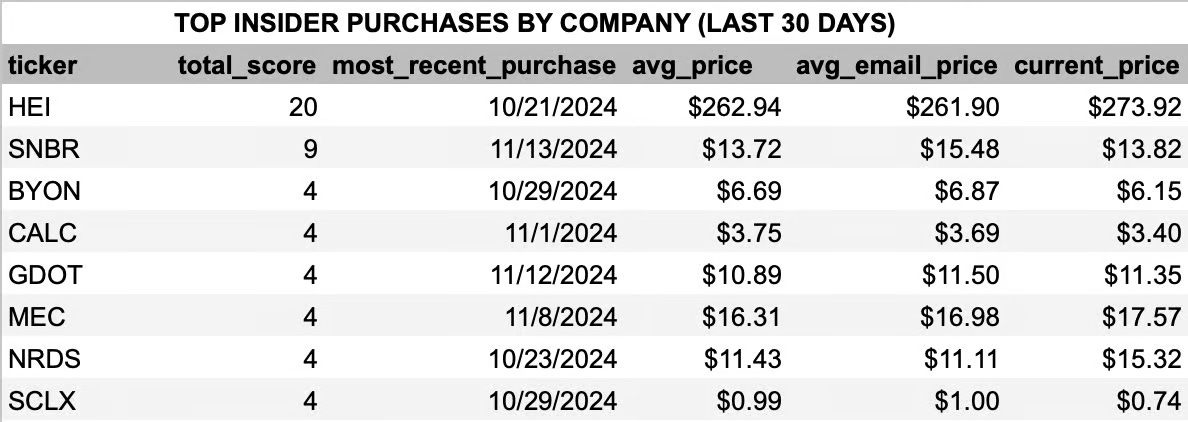

Top Purchases by Company

The companies with the most top insider purchases in the last 30 days.

SNBR gained a few more points after the Top Purchase today.

Click here to access the spreadsheet (it has many more rows and more return calculations for each row).