Good Afternoon!

Insider trades can reveal valuable insights into where executives and insiders see potential. By analysing recent activity, I've uncovered a few standout opportunities that could offer promising returns.

After sifting through 346 insider trades, I’ve calculated which ones show the most promise, and here’s what I found:

- $XGN: Up 20% in one day after insider activity

- Two more 3-point purchases

- and a whole lot more…

I’ll keep digging into the data to bring you the latest and most actionable insider moves every day.

Have a fantastic day!

Jack

P.S. Click here for the Google Sheet with all of the data for the last 30 days.

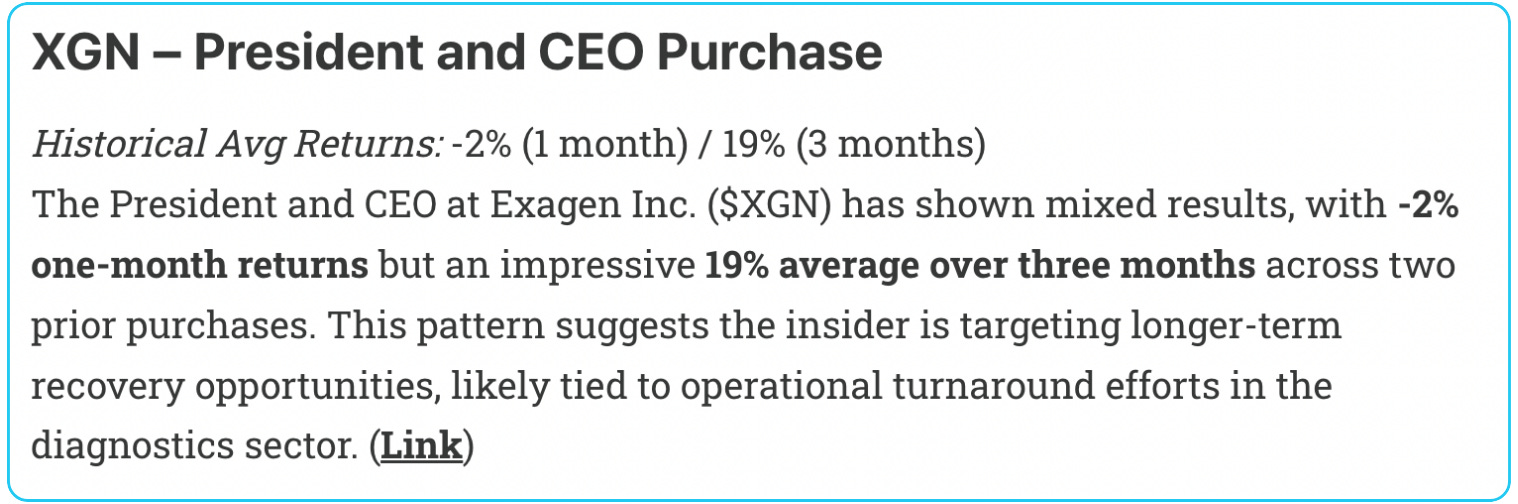

💰 Previous Winner

Exagen Inc. (NASDAQ: XGN) saw a sharp 20% stock price increase on November 19, 2024, likely spurred by the market's reaction to insider trading activity and strategic updates. The company, specializing in diagnostic solutions for autoimmune diseases, had reported mixed Q3 financial results earlier in the month. While it missed revenue estimates ($12.5M vs. expected $13.57M), there was a narrowing of net losses and improved cash management, signaling enhanced operational efficiency.

The CEO's recent insider purchase might have reinforced investor confidence, signaling that management sees significant value in the company despite short-term challenges. Exagen's pricing power, shown by a 26% year-over-year increase in the average selling price of its AVISE CTD tests, also suggests strong demand for its flagship diagnostic products.

It opened at $2.94 and is up to $3.53.

New 3-Point Purchases

3-point purchases are the highest-rated insider trades. Remember, returns and win rates are calculated using the previous purchase trades by the insider.

Director Purchase at WillScot Holdings Corp. ($WSC)

In a significant insider trade, a Director at WillScot Holdings Corp. ($WSC) purchased 5,000 shares at $34.99 per share, amounting to a total investment of $175,000. This transaction increased their vested holdings by 1.2%, bringing their total holdings to a noteworthy level. Currently, the stock trades at $35.14, reflecting a modest 0.4% gain since the purchase. Importantly, this marks their second-largest transaction out of five total historical purchases, well above their median purchase size of $62,609.70.

Why This Insider Purchase Stands Out

This transaction deserves attention due to the insider's remarkable historical performance. Previous trades by this Director have yielded exceptional results:

- 1-Month Returns: 51% weighted and 52% median with a perfect 100% win rate (3/3 transactions).

- 3-Month Returns: 60% weighted and 61% median with a 100% win rate.

- 6-Month Returns: 85% weighted and 76% median, maintaining a flawless 100% win rate.

- 1-Year Returns: An impressive 305% weighted and 282% median return, again with a 100% win rate.

The consistency of these returns demonstrates an insider with an exceptional ability to time their purchases, aligning with moments of significant stock price appreciation.

Technical and Fundamental Analysis

At $35.14, $WSC trades near its 52-week high of $36.20, signaling strong bullish sentiment. The stock’s Relative Strength Index (RSI) currently hovers around 68, nearing overbought territory but not yet signaling a pullback. The volume following this insider purchase has shown an uptick, suggesting heightened investor interest, potentially driven by the insider activity and broader confidence in the company's fundamentals.

From a moving average perspective, $WSC is trading well above its 50-day and 200-day moving averages ($33.20 and $31.50, respectively), further confirming its upward momentum. A breakout past the 52-week high could act as a catalyst for additional buying pressure.

Broader Industry Context and Company Positioning

WillScot Holdings operates in the modular space and storage solutions industry, a sector benefiting from increased infrastructure investments and a robust construction pipeline. The company’s financial health is strong, with consistent revenue growth, stable cash flow, and a scalable business model. Recent quarterly reports highlight expansion opportunities and operational efficiencies, aligning well with macroeconomic trends favoring infrastructure and development.

This insider purchase coincides with a period of strategic growth for WillScot, including potential contract wins and expansions that could significantly boost its valuation. Notably, two other insiders also recently acquired shares, reinforcing confidence in the company’s future trajectory and potential catalysts for value creation.

Sentiment and Market Implications

Insider transactions at $WSC have historically acted as precursors to meaningful price movements. The alignment of this insider purchase with the stock’s technical strength and bullish industry trends suggests a high likelihood of continued appreciation. Moreover, the presence of multiple insider buys amplifies the signal, indicating a collective belief in undervaluation or impending positive developments.

Investors should monitor $WSC closely, particularly for a breakout above the 52-week high. Such a move could attract momentum traders and institutional interest, potentially driving the stock to new highs. Conversely, a failure to sustain its current levels might indicate consolidation, offering long-term investors an opportunity to accumulate shares.

Summary

This Director’s $175K purchase of $WSC shares stands out due to its size, timing, and the insider’s flawless track record of generating outsized returns. With strong technical indicators, positive sentiment, and supportive industry dynamics, this transaction provides a compelling case for bullish momentum in the stock. The combination of insider confidence, favorable market conditions, and potential catalysts makes $WSC a stock to watch in the coming months. (Link)

Director Purchase at Telos Corp. ($TLS)

A Director at Telos Corp. ($TLS) recently purchased 4,000 shares at $3.35 per share, amounting to a total investment of $13,400. This transaction increased their vested holdings by 2.7%, indicating a moderate addition to their overall stake. Interestingly, this is the Director's third-largest purchase out of seven all-time transactions, above their median purchase size of $11,000. However, following the purchase, the stock price dipped by 6.0% to $3.15, suggesting potential short-term volatility in the market's reaction.

Why This Insider Purchase Stands Out

Despite the immediate price decline, this purchase is noteworthy for several reasons:

- 1-Month Returns: 14% weighted and 21% median, with a 67% win rate (4/6).

- 3-Month Returns: 25% weighted and 30% median, also with a 67% win rate.

- 6-Month Returns: 19% weighted and 35% median, with an 80% win rate (4/5).

- 1-Year Returns: A stellar 36% weighted and 54% median, with a 100% win rate (3/3).

The Director’s insider trading history demonstrates a strong ability to identify value and capitalize on future price increases. This suggests that, despite the current price decline, the purchase might signal a longer-term opportunity.

Technical and Fundamental Analysis

At $3.15, $TLS is trading near its 52-week low, which could signify undervaluation. The Relative Strength Index (RSI) currently reads below 40, indicating that the stock may be approaching oversold territory. This could attract technical traders looking for rebound opportunities.

Additionally, the stock’s 50-day and 200-day moving averages ($3.45 and $4.25, respectively) suggest bearish momentum, but insider activity at these levels often precedes a reversal, especially when aligned with broader company fundamentals.

Broader Industry Context and Company Positioning

Telos Corp. operates in the cybersecurity and IT solutions sector, a high-growth industry that remains critical amid increasing global cybersecurity threats. While the company has faced recent challenges reflected in its stock performance, it retains a strong reputation for providing secure communications and enterprise solutions to government and commercial clients.

This insider purchase coincides with broader industry tailwinds, such as heightened demand for advanced cybersecurity infrastructure. The timing of the transaction suggests insider confidence in Telos's ability to stabilize operations or secure key contracts that could drive revenue growth.

Sentiment and Market Implications

The insider's transaction sends a mixed signal to the market. On one hand, the relatively modest purchase size compared to other insiders in similar roles could indicate caution. However, the insider's track record of delivering strong returns through previous trades adds weight to this transaction, particularly given its alignment with historical patterns of successful buying near price troughs.

Investors should watch for any near-term developments that might act as catalysts, such as new contract announcements or improved guidance in upcoming earnings reports. Additionally, a break above $3.50 could signal a reversal of bearish sentiment, opening the door for upside momentum.

Summary

The Director’s $13,400 purchase of $TLS shares, though modest, aligns with an insider history of strong returns and confidence during periods of market undervaluation. While the stock’s immediate decline to $3.15 raises questions, the broader context of the company’s positioning in the cybersecurity industry and the insider’s historical success suggest this transaction could signify a longer-term opportunity. Investors seeking value in high-growth sectors should keep a close eye on Telos Corp. for potential catalysts and technical breakouts.

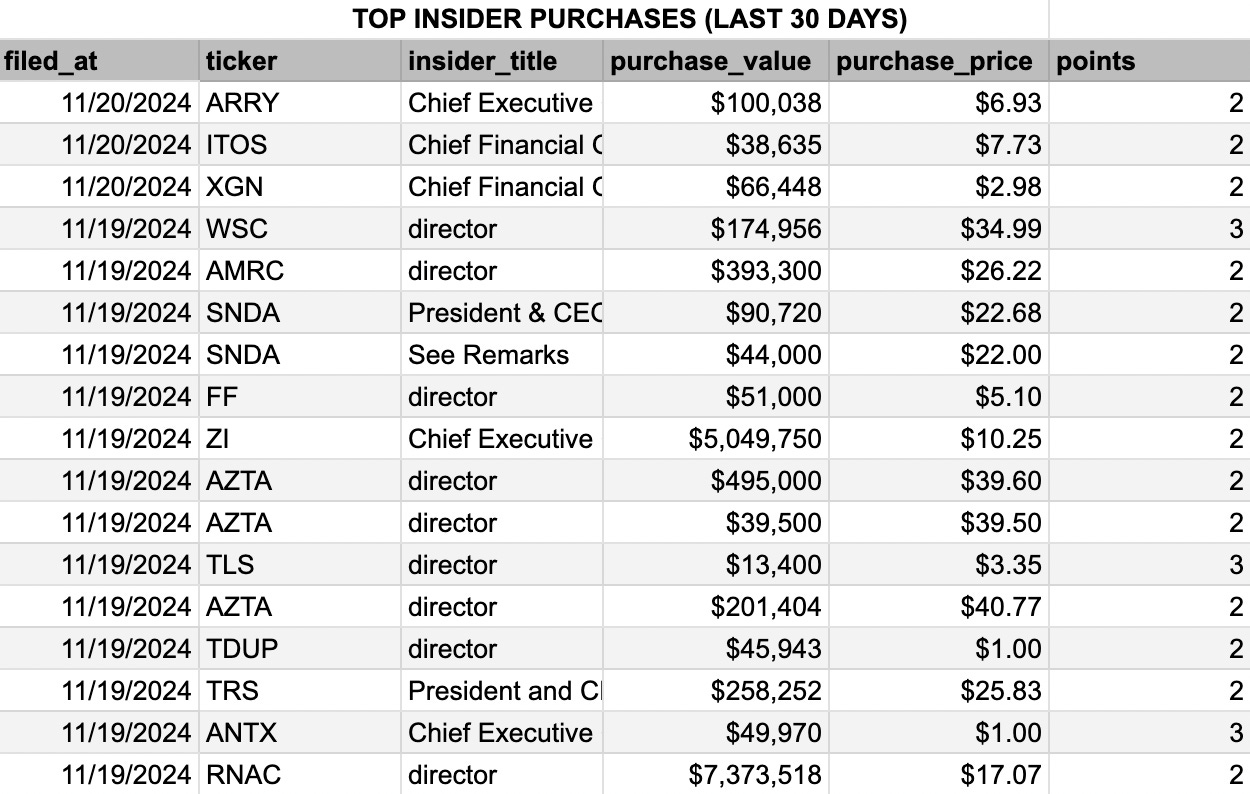

All New Top Purchases

The top purchases made by insiders yesterday. Remember, returns and win rates are calculated using the previous purchase trades by the insider.

All of these are the first Top Purchases in the last 30 days, except for WSC, SNDA, XGN, and TDUP:

- -6% 1m / 54% 3m avg returns on 1 previous purchase for the Chief Executive Officer at ARRY - (Link)

- 2% 1m / 16% 3m avg returns on 2 previous purchases for the Chief Financial Officer at ITOS - (Link)

- 10% 1m / 38% 3m avg returns on 5 previous purchases for the Chief Financial Officer at XGN - (Link)

- 52% 1m / 61% 3m avg returns on 4 previous purchases for the director at WSC - (Link)

- 12% 1m / 3% 3m avg returns on 1 previous purchase for the director at AMRC - (Link)

- 10% 1m / 1% 3m avg returns on 3 previous purchases for the President & CEO at SNDA - (Link)

- 3% 1m / 28% 3m avg returns on 1 previous purchase for the See Remarks at SNDA - (Link)

- 2% 1m / 9% 3m avg returns on 8 previous purchases for the director at FF - (Link)

- 6% 1m / 30% 3m avg returns on 1 previous purchase for the Chief Executive Officer at ZI - (Link)

- 12% 1m / 17% 3m avg returns on 1 previous purchase for the director at AZTA - (Link)

- 7% 1m / 8% 3m avg returns on 7 previous purchases for the director at AZTA - (Link)

- 21% 1m / 30% 3m avg returns on 6 previous purchases for the director at TLS - (Link)

- 9% 1m / 10% 3m avg returns on 3 previous purchases for the director at AZTA - (Link)

- 16% 1m / 20% 3m avg returns on 4 previous purchases for the director at TDUP - (Link)

- 10% 1m / 12% 3m avg returns on 7 previous purchases for the President and CEO at TRS - (Link)

Click here to access the spreadsheet (it has many more trades, links to all of the trades, and return calculations for each trade)

Top Purchases by Company

The companies with the most top insider purchases in the last 30 days.

AZTA jumped up to 3rd after today’s 3 Top Insider Purchases, WSC moved up to 4 after the director’s 3-point purchase, and SNDA, XGN, and TDUP all show up on the Top Company List for the first time.

Click here to access the spreadsheet (it has many more rows and more return calculations for each row).