Good Afternoon!

Insider trades can reveal valuable insights into where executives and insiders see potential. By analysing recent activity, I've uncovered a few standout opportunities that could offer promising returns.

After sifting through 301 insider trades, I’ve calculated which ones show the most promise, and here’s what I found:

- $XGN: Up 50% in 2 days after insider activity

- $ENPH: Another 3-point purchase by the CEO

- and more…

I’ll keep digging into the data to bring you the latest and most actionable insider moves every day.

Have a fantastic day!

Jack

P.S. Click here for the Google Sheet with all of the data for the last 30 days.

💰 Previous Winner

Over the past two days, five stocks highlighted in the newsletter have already shown gains exceeding 14%. The average return of all top insider purchases shared during this period is over 4.5%, significantly outperforming the S&P 500's ~1% during the same time.

One standout example is Exagen Inc. (XGN), which saw a remarkable 48% increase in just two days. This surge followed its Q3 2024 earnings report, where Exagen surpassed revenue expectations, posting $12.5 million. The company also gained attention for its advancements in autoimmune disease diagnostics, which further bolstered investor confidence.

It opened at $2.94 and is up to $4.37 (+48%).

New 3-Point Purchases

3-point purchases are the highest-rated insider trades. Remember, returns and win rates are calculated using the previous purchase trades by the insider.

CEO Purchase at Enphase Energy, Inc. ($ENPH)

In a noteworthy move, the President and CEO of Enphase Energy, Inc. ($ENPH) purchased 5,000 shares at $61.75 each, amounting to a $309,000 transaction. This purchase increased their vested holdings by 0.3% and currently sits at a modest gain, with the stock trading at $63.38 (+2.6%). Notably, this represents the CEO’s second-largest transaction out of ten total purchases, far exceeding their median purchase size of $117,000. The magnitude and timing of this acquisition highlight a potential strategic insight into the company’s future performance and growth trajectory.

Why This Insider Activity is Significant

The purchase stands out not only because of its size but also because of the President and CEO's historical ability to generate substantial returns from insider trades. Over the past year, insider transactions from this executive have yielded an impressive track record, with weighted 1-month returns of 16%, rising to 56% over 3 months, and culminating in a remarkable 85% over 6 months. Most notably, the 1-year weighted return sits at an extraordinary 335%, underscoring the CEO's consistency in identifying favorable entry points.

The historical win rate for these trades adds further weight: 75% over one month, increasing to a perfect 100% over three and six months. Even over a full year, where market volatility can play a larger role, the win rate remains strong at 86%. This consistency signals a sharp understanding of both internal company dynamics and broader market conditions, suggesting that this particular purchase could precede another period of outperformance for $ENPH.

Technical Analysis of $ENPH

From a technical perspective, $ENPH has been trading at what appears to be a significant support level around the low $60s. This level has historically acted as a key inflection point for the stock, with previous insider purchases at similar prices yielding substantial gains. The stock's recent bounce to $63.38 suggests the potential beginning of a reversal pattern, with initial resistance seen at the $67.50 range. Should the stock break through this level, the next major resistance sits closer to $75, which could offer a near-term upside of over 18%.

The Relative Strength Index (RSI) for $ENPH indicates the stock is recovering from oversold conditions, hovering just below the neutral 50 level. This suggests the stock is regaining momentum, particularly as the moving averages begin to converge. The 20-day exponential moving average (EMA) is nearing a crossover above the 50-day EMA, a bullish signal often indicative of continued upward momentum. Volume patterns further support this analysis, with recent trading sessions showing accumulation rather than distribution.

Sector and Market Position

Enphase Energy operates within the rapidly evolving renewable energy sector, a space characterized by high growth potential but also increased competition and policy-driven volatility. The company specializes in solar microinverters and energy storage solutions, positioning itself as a leader in the clean energy transition. This purchase may signal confidence in the company’s ability to maintain its market share amidst ongoing challenges such as tightening margins and fluctuating demand in international markets.

Recent industry trends suggest a renewed focus on distributed energy solutions, bolstered by government incentives and corporate investments in sustainability. Enphase is uniquely positioned to capitalize on these trends, and insider buying at this level could indicate that significant contracts, product launches, or geographic expansions are on the horizon.

Broader Implications of Insider Confidence

The size of this purchase, relative to the CEO’s historical activity, suggests a deliberate and calculated move rather than a routine accumulation of shares. When insiders make larger-than-usual transactions, it often signals heightened confidence in upcoming catalysts. In this case, the CEO's decision to increase holdings during a period of market uncertainty for renewables may reflect knowledge of internal developments that could positively impact shareholder value.

Additionally, the insider's timing aligns with broader market dynamics. The renewable energy sector, including solar stocks like $ENPH, has recently seen a pullback, creating attractive entry points for long-term investors. If this purchase precedes favorable announcements—such as earnings beats, partnerships, or regulatory tailwinds—it could mark the beginning of a significant upward trend for the stock.

Historical Returns on Insider Trades

The CEO's previous insider transactions at Enphase have delivered exceptional returns:

- 1-Month Returns: Weighted at 16%, with a median of 18%, and a win rate of 75% (6 out of 8 trades).

- 3-Month Returns: Weighted at 56%, with a median of 61%, and a perfect win rate of 100% (8 out of 8 trades).

- 6-Month Returns: Weighted at 85%, with a median of 99%, and a win rate of 100% (8 out of 8 trades).

- 1-Year Returns: Weighted at 335%, with a median of 217%, and a win rate of 86% (6 out of 7 trades).

The 6-month and 1-year performance metrics are particularly striking, suggesting that the CEO’s trades tend to align with meaningful company milestones or broader market trends.

Summary

The President and CEO’s recent purchase of $ENPH shares is a compelling signal for investors, combining strong historical insider performance with bullish technical and fundamental indicators. The stock’s current price level suggests it may be undervalued, particularly given Enphase’s leadership position in the renewable energy sector and its potential to benefit from upcoming catalysts. With the insider's proven track record of identifying strategic buying opportunities, this transaction underscores a high level of confidence in the company’s future trajectory, making it a standout opportunity for those seeking exposure to growth in clean energy. (Link)

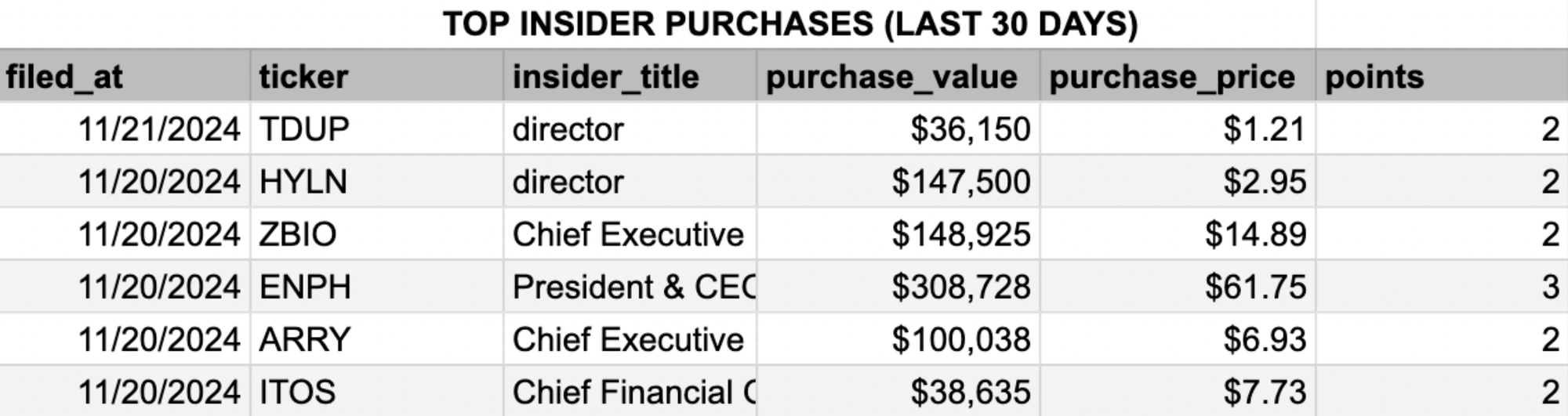

All New Top Purchases

The top purchases made by insiders yesterday. Remember, returns and win rates are calculated using the previous purchase trades by the insider.

Repeat Top Insider Purchases at TDUP and ENPH and the first Top Purchases at the other companies:

- 16% 1m / 20% 3m avg returns on 5 previous purchases for the director at TDUP - (Link)

- 11% 1m / 162% 3m avg returns on 1 previous purchases for the director at HYLN - (Link)

- 21% 1m / 17% 3m avg returns on 4 previous purchases for the Chief Executive Officer at ZBIO - (Link)

- 18% 1m / 61% 3m avg returns on 9 previous purchases for the President & CEO at ENPH - (Link)

Click here to access the spreadsheet (it has many more trades, links to all of the trades, and return calculations for each trade)

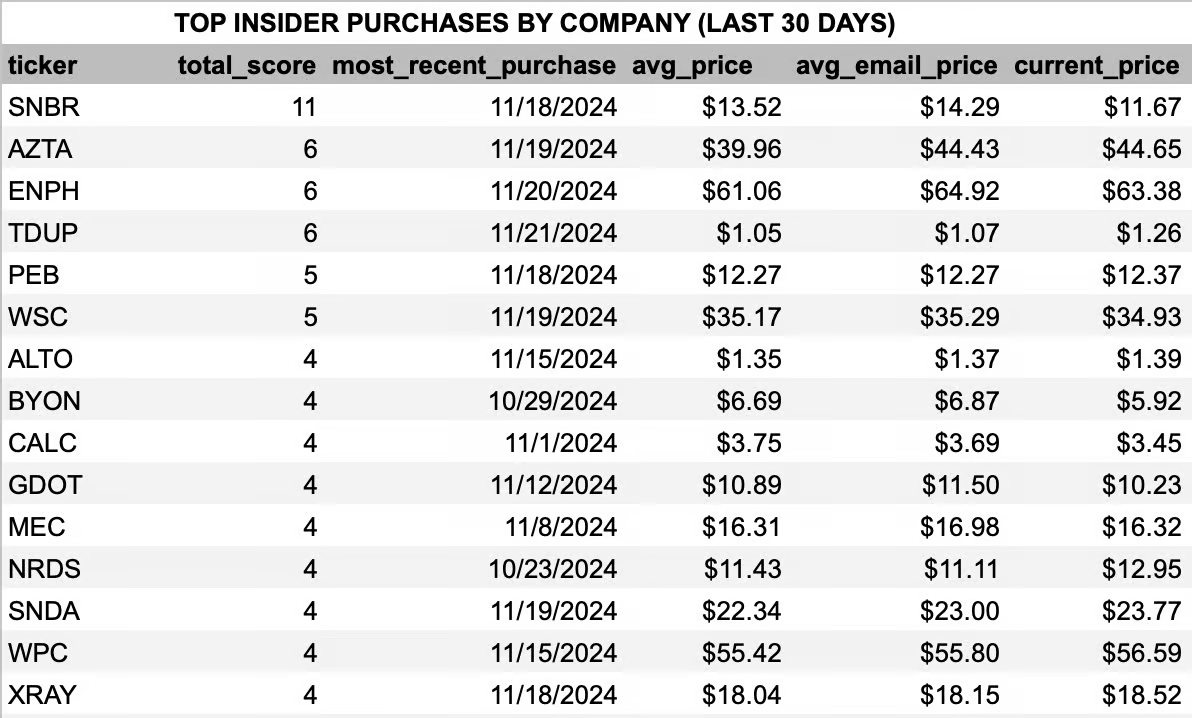

Top Purchases by Company

The companies with the most top insider purchases in the last 30 days.

$ENPH moves into 3rd with another 3-point purchase by the CEO while $TDUP also moves into 3rd after today’s Top Insider Purchase.

Click here to access the spreadsheet (it has many more rows and more return calculations for each row).